Update on memory

Why should Micron be worth more than SK Hynix?

3 months ago, I wrote about the upcoming memory shortage as Micron and Hynix do not have sufficient cleanroom space for capacity expansion. Both Micron and Hynix have since announced more capacity expansion which are bullish for the semicap.

2 weeks after my post, Hynix announced the expansion of M15X in Cheongju. M15X was actually supposed to be a new NAND plant beside M15, but the memory shortage has driven Hynix to use the infrastructure for DRAM and HBM. In May, rumour starts to emerge that Micron might set up another DRAM plant in Hiroshima for production by 2027.

During the latest earnings, Micron guided for FY 2024 capex of $8 billion (WFE spending down YoY) and FY 2025 capex of mid 30% of revenue. With an estimated revenue of $35 to $40 billion, we will be looking at a capex of about $12 billion before we include the Chips Act subsidies of up to $6 billion.

Despite these new announcements, there is still no change to my prediction of tightening DRAM supply into 2025. Micron has indicated that more than half of the increase will be dedicated to US fab construction. The Idaho greenfield will also contribute meaningful supply from 2027 although it will start mass production in 2026. Micron’s insertion of EUV at 1-gamma also plays a role in the capex increase. For Hynix, M15X will help to mitigate Wuxi DRAM capacity which is stuck at 1a nm. Hynix will continue to use 1b nm for its HBM3E capacity.

Update on HBM

Hynix continues to dominate the HBM market with its proprietary MR-MUF method which offers better heat dissipation. While there were excitement around Micron’s progress in HBM3E, market has started to realize that the progress is slower than street’s optimism .

Perhaps, the easiest way to track progress in HBM is to track the contract liabilities which constitutes prepayment from customers (mostly Nvidia). Hynix’s prepayment has grown from KRW 0.7 trillion in Q3 2023 to KRW 1.6 trillion in Q4 2023 and KRW 2.8 trillion (USD 2 billion) in Q1 2024. Micron first announced a prepayment of $600 million in FY 2024 Q1. 2 quarters later and the prepayment amount on the balance sheet is only $756 million. Hynix’s prepayment is 4x bigger than Micron and it will be interesting to see what the final amount is when Hynix reports at the end of the month.

Source: Micron Q3 10-Q

As for Samsung, they will probably get qualified sometimes in the future or perhaps never. Hybrid bonding might be what Samsung will need to stand a better chance to get qualified.

NAND - SSD demand is picking up

The acquisition of Solidigm by Hynix was a questionable decision as the NAND market has gotten pretty bad since the close of the acquisition. Hynix got lucky a second time this cycle as they are the market leader of ultra high density SSD solution. Solidigm is the only supplier at the moment although Samsung will introduce them in 2H 2024.

Hynix vs Micron

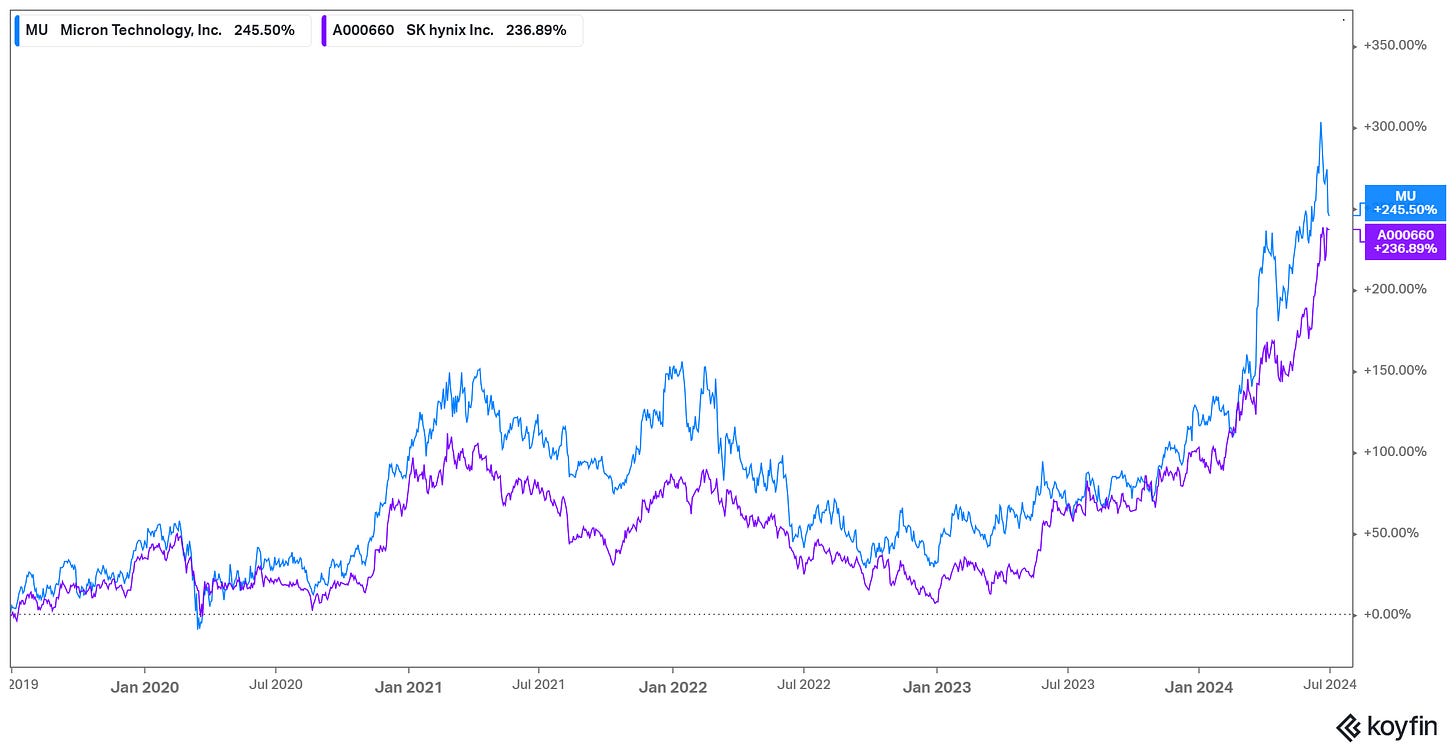

Anyone who has tracked the share price of Micron and Hynix will have realized that they are highly correlated to each other. Despite Hynix’s market share gain with its dominance in HBM3 and high density enterprise SSD, Micron’s market cap is more than 15% higher than Hynix. Hynix has a higher market share in DRAM bit, HBM and NAND than Micron. Hynix will also have higher ASP and profitability in both DRAM and NAND than Micron in this cycle. Micron looks relatively expensive at 3x FY 2025 PB vs Hynix who is only trading at 1.6x FY 2025 PB. It is clear that they trade in different markets, but that is too big a discount for Hynix.

Source: Koyfin

Semicap

Nothing surprising for semicap given the run in share price of Lam Research and Kokusai who have more exposure to memory. For ASML, Micron did highlight that 1-gamma ramp in Taiwan and Hiroshima will be the key to its near term bit growth. With all 3 DRAM manufacturers ramping up their EUV capacity, this is positive for ASML before the start of High NA EUV adoption. TSMC will also likely raise its capex as the demand for N3 and N2 are stronger than expectation.

May I ask why you are not so sure about Samsung's HBM? Many equity analysts suspect the company will eventually get a qualification status from NVDA with its probability weighted equally between later this year and next year. But I suspect you have another insight I am very curious to know about.