Memory Shortage and ASML

HBM, EUV, Wuxi, AI smartphone and PC

Implications

Supply is tight and will only get tighter

Samsung is the only memory vendor that is unconstrained in capacity expansion

Hynix will have difficulty in migrating beyond 1a nm at Wuxi

Migration to 1c and 1-gamma will drive up EUV adoption

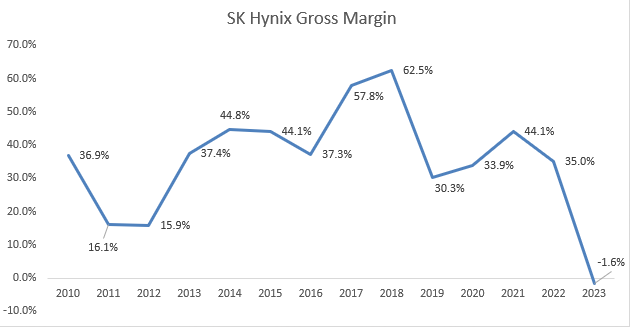

Although we are down to 3 major DRAM manufacturers, memory has always been a commodity since the 1970s. The wild swing in gross margin for SK Hynix in a year proves the point. Supply is the underlying driver of the memory cycle. Memory prices should always trend down over time with cost as memory manufacturers migrate to the next process node that allows for higher bit per wafer. There is always a duration mismatch in demand and supply due to the inelasticity of supply. When there is supernormal profit, capex will go up and supply will follow in 2 to 3 years. Supply will exceed demand and DRAM prices should fall to cost theoretically. This post will instead focus on the current upcycle and how it could actually be stronger than the 2016 cycle.

How we get here today is a result of the proliferation of AI and the worst downcycle since the GFC. To be fair, the 2022 downcycle was driven by a broad-based inventory correction across all the verticals rather than very aggressive capex hike from the memory producer. The downcycle led to negative gross margin for SK Hynix, Micron and Kioxia. Negative gross margin led to going concern risk, which led to Hynix and Micron cutting their capex to the lowest level in the last 7 years. This is despite the fact that we have moved from 1x nm to 1b nm which will require higher capex per wafer.

HBM

HBM (High Bandwidth Memory) has become very important in AI training, and you can’t run away from talking about HBM if you are looking at DRAM. Nvidia has moved from HBM2e at A100 to HBM3 at H100 and HBM3e at H200. The number of dies stack will also be moving up from 8-hi in 2024 to 12-hi in 2025 and 16-hi HBM4 in 2026. Hynix will continue to dominate HBM especially after the recent relaxation of height limit for HBM4 by JEDEC (bad news for BESI). MR-MUF offers the best heat dissipation as compared to TC-NCF used by Samsung and Micron. MR-MUF is protected by patent and exclusive supply agreement with its key Japanese epoxy resin supplier.

HBM affects current and future DRAM supply in 2 different ways. The 1st is cannibalization of capex from DRAM and NAND where Fabricated Knowledge gave a very good analogy. The 2nd is as Micron mentioned in the last call that “HBM3E consumes approximately three times the wafer supply as DDR5 to produce a given number of bits in the same technology node”. In fact, this ratio will only get worse in 2026 as HBM4 can consume up to 5x the wafer supply as DDR5. The way it works is a HBM die size is double that of DDR5 (which already suffers from single digit die size penalty vs DDR4). HBM die size will only get bigger as more TSV is needed. Yield rate of HBM3e is below 70% and will only get harder as more dies are stacked beyond 8-hi. Logic base die of the HBM module is currently produced in-house by Micron and Hynix although this could be outsourced to TSMC for HBM4. In summary, not only is HBM consuming more of current wafer supply, but it is also cannibalizing the capex for future DRAM and NAND capacity expansion.

Capacity Expansion

In past upcycles, capex will often go up as memory producers gain confidence. Nobody wants to lose market share as current capex = future capacity → future market share. However, SK Hynix and Micron will be unable to expand their DRAM wafer capacity meaningfully in 2024 and 2025.

SK Hynix has limited cleanroom space available for DRAM expansion (~45k wpm) at M16 and this will be fully utilized by 2025. The company will have to wait till 2027 before Yong-In fab can be completed. Even when the balance sheet situation for SK Hynix improves in 2025, it will be limited by its cleanroom space.

For Micron, the situation is slightly better. Taichung fab also has limited space available for capacity expansion, but this will likely be earmarked for HBM production. Micron will have to wait until the new Boise fab is ready in 2026. Both Micron and Hynix will be limited in capacity expansion in 2025 against their will.

Similar situation applies for NAND although both Hynix and Micron are also unwilling to spend on NAND given the higher priority of HBM and EUV in 2024. Kioxia is unlikely to have the cash flow for capacity expansion given the losses and leverage.

Samsung is the only company that is able to expand DRAM and NAND capacity as they wish to.

Rising adoption of EUV in memory → Positive for ASML

Given the constraint of cleanroom space, both Hynix and Micron will have to rely on process migration to increase their die per wafer for DRAM. Hynix will be prioritizing the migration to 1a and 1b nm in 2024 (crossover of 1a and 1b at the end of 2024), followed by 1c nm. Micron will be introducing EUV at 1-gamma in its Hiroshima fab in 2025. Samsung will accelerate the migration to 1c nm in 2024 after lagging behind Hynix at 1a nm.

The focus on 1c nm and 1-gamma is positive for ASML. 1-gamma will be the 1st time that Micron is introducing EUV for DRAM although this will only be 1 EUV layer. The introduction of 1c nm for both Samsung and Hynix will represent 6-8 EUV layers. The number of EUV layers is between the EUV layers of TSMC’s N7 and N5. Rising EUV intensity for DRAM is beneficial to ASML and they have reported 50% of EUV orders in Q4 2023 coming from DRAM. High-NA EUV adoption for memory might be earlier than 2030 as the DRAM producers could be stuck after 1d nm. It will likely be High-NA EUV before 3D DRAM.

There is 1 issue again for SK Hynix as Wuxi fab is 45% of their DRAM capacity. Given that no EUV machine can be shipped to China, SK Hynix’s Wuxi fab will face difficulty in migrating beyond 1a nm. The current turnaround is for Hynix to ship their wafer from Wuxi to M16 for EUV processing before it is shipped back to Wuxi again. With higher EUV layers beyond 1a nm, this will increasingly be difficult. Close to half of Hynix’s DRAM capacity will become legacy node and they cannot migrate to generate more bits per wafer.

Optionality: AI smartphone and PC

With the supply constrain, HBM cannibalization and strong AI demand, the memory cycle will stay strong through 2025. How much higher it can go depends on the adoption of AI smartphone and PC from late 2024.

We have seen some success from Samsung S24 Ultra’s adoption of AI although it does not meet the definition of AI smartphones. With the launch of Qualcomm’s Snapdragon 8 Gen 4, Mediatek’s Dimensity 9400, Qualcomm’s Elite X, AMD’s Kraken Point and Intel’s Lunar Lake from late 2024 (all produced at TSMC), we could see AI smartphone and PC taking off.

The way to think about AI smartphone and PC is 5G (50% penetration rate after 3 years). We have seen limited use case for 5G, but we buy 5G smartphone because those are the options available for mid to high-end smartphones. Adoption of AI smartphone and PC is driven by supplier than customer. This is different from AR/VR where there is no replacement demand.

AI smartphone and PC will lead to higher DRAM content per box even with stagnant smartphone and PC sales. Both AI PC and AI smartphone will require at least 16GB and 12GB of DRAM respectively vs the standard 8GB today. This is content growth of 50-100%.

Conclusion

The memory upcycle is far from over as this cycle has its idiosyncrasy. However, we should not be deluded to think that there is no more cycle. Investor in memory stock has to exit 6 to 9 months before the next downcycle. The coast is still clear for DRAM prices in 2025.