The 3 KPIs of TSMC

In an interview 8 years ago, Morris Chang (founder of TSMC) brought up the 3 most important performance indicators that he used to monitor the health of TSMC.

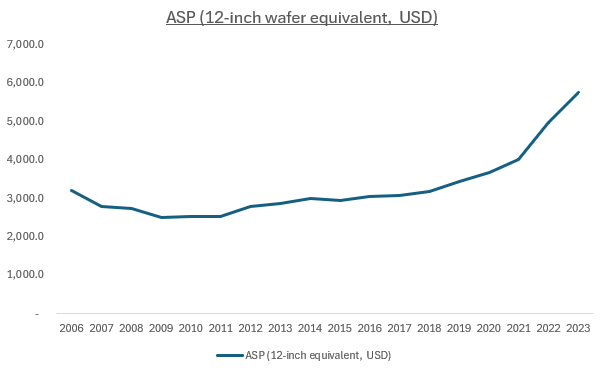

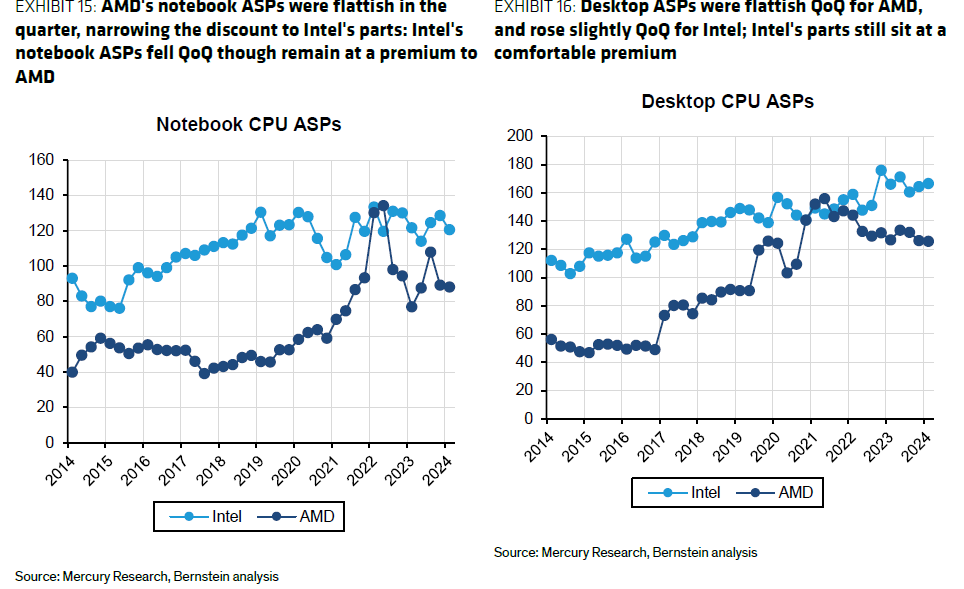

ASP growth

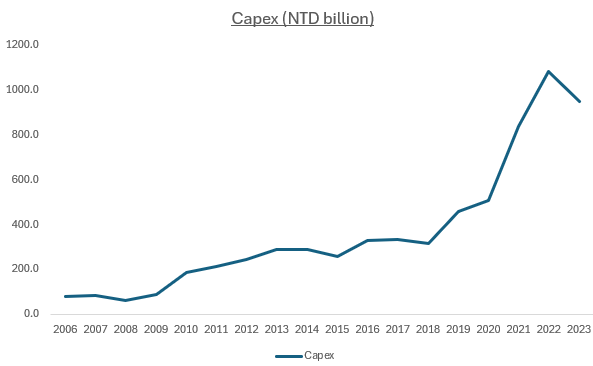

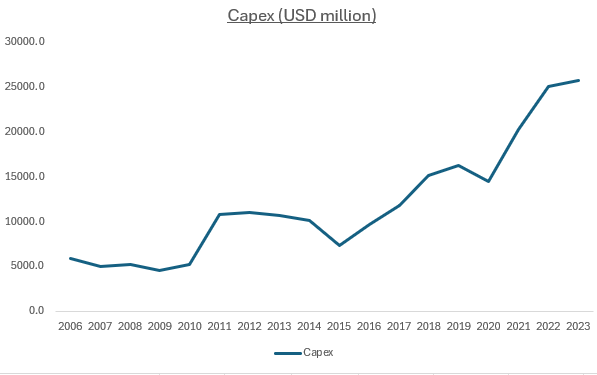

Capex

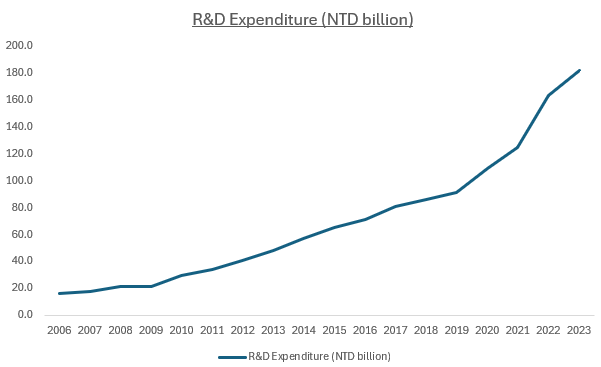

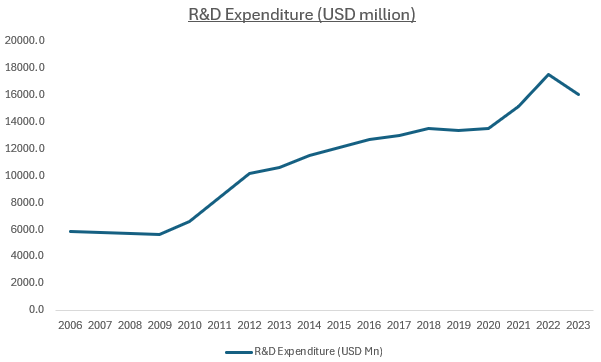

R&D expenditures

ASP growth represents pricing power which is an indication of the current technological superiority of TSMC’s process.

Capex today is capacity and market share in the future. If TSMC does not spent on 2nm capex in 2023, there will not be any 2nm revenue in 2025.

R&D expenditure correlates to the future technological superiority of TSMC’s process.

As long as all 3 KPIs are going up, Morris Chang knew that TSMC is on the right track. And that is what Morris Chang did when he returned in 2009 to replace Rick Tsai (current CEO of Mediatek) as the CEO of TSMC. He immediately doubled TSMC’s capex in 2010 to USD 5.9 billion, which allowed them to capture the smartphone market. R&D expenditure which had been flat for a few years was accelerated. ASP began to inflect in 2012 after years of decline.

All 3 indicators continue to show positive long-term trend ever since Morris Change came back in 2009. In particular, TSMC’s ASP started to grow at high single digit per year from 2019 to 2021 and further rose to double digit growth rate in 2022 and 2023. 2018 was the introduction of TSMC’s N7, the 1st node where TSMC achieved process node parity with Intel. The rest was history.

Source: TSMC

Intel’s Opex Cut

Reductions across OpEx, CapEx and cost of sales totaled well over $10 billion in direct savings in 2025 and provides clear line of sight to a sustainable model with the ongoing financial resources and liquidity needed to support our long-term strategy.

We remain confident that we have and will continue to make the investments needed to drive long-term shareholder value and we view cost discipline as the compass that drives effective execution, helping teams stay on track to both prioritize and achieve measurable results. The operational and capital improvements we are driving will be especially important as we manage the business through the near term.

Source: Intel Q2 2024 earnings

Contrary to Morris Chang’s turnaround strategy in 2009, CEO Pat Gelsinger decided to cut operating expenses (R&D is 2/3 of total opex) from $21.7 billion in 2023 to $20 billion in 2024, $17.5 billion in 2025 and reduce again in 2026. All these while the cost to keep up with Moore’s Law continues to go up as we navigate through GAA, Backside Power Delivery, High-NA EUV and CFET.

Gross capex will also be cut by 20% to $25-27 billion in 2024 and $20-23 billion in 2025. On the other hand, TSMC’s capex will continue to go up in 2025 as capital intensity is maintained in the 30s while revenue is expected to grow.

Source: Intel

Source: Bernstein

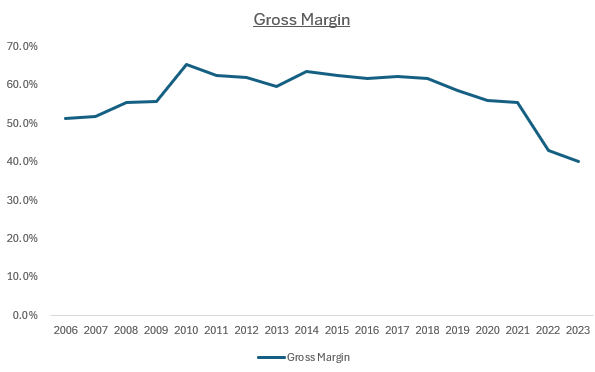

I have decided to use gross margin as a proxy of ASP for Intel. If the foundry process is not competitive, Intel will have to outsource more to TSMC. This is what is happening with the outsourcing of Lunar Lake to TSMC. Although Intel is bringing in Panther Lake in-house, next-generation Nova Lake is likely back to TSMC again.

I think on the margin front, I talked about our kind of tempered view of gross margins next year, given the ramp of Lunar Lake, which with memory and package and almost all of the material getting sourced outside and they're seeing -- we're seeing inflation in that space. That is impacting it. But that part is followed by Panther Lake. That comes back into the fab.

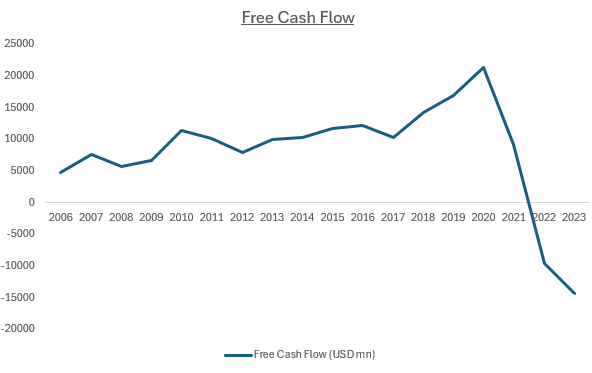

When Pat Gelsinger came back to Intel in 2021, he did raise capex and R&D spend in 2022. However, 2022 was also the year where Intel started to suffer from negative free cash flow. Inventory correction happened for PC as demand was brought forward during Covid.

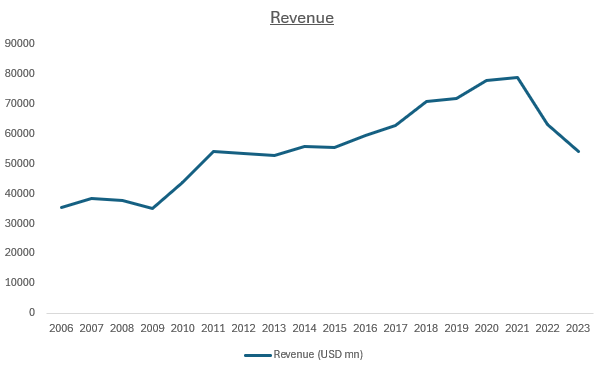

Here are 3 more charts to illustrate why Intel was never able to keep up with the 3 KPIs earlier.

Source: Intel

Having missed the smartphone and AI product cycle, Intel is left with a stagnant CPU market. Superiority in process node manufacturing was a key moat for Intel’s product, which got worse when TSMC achieved process parity with Intel after 2018. Competition in the form of AMD, AWS’s Graviton, Apple’s M series, Qualcomm X Elite is increasing as these companies are able to fight on a more even playing field with the help of TSMC. Today, Microsoft, Meta and Google are also in the process of designing their in-house ARM-based CPU to be manufactured at TSMC. The rise of Nvidia was another significant hit to Intel as demand for AI processors cannibalizes server CPU demand.

And then ultimately, I think on pricing, it will really come down to when we have a competitive process, and we have competitive products running on a competitive process, and we're delivering what the customers want. That helps us in terms of the pricing dynamic

Source: CFO of Intel in Q2 2024 earnings

At best, Intel is only able to defend against further share loss in a stagnant CPU market even if it has a competitive product on competitive process. Revenue this year will be closer to where it was in 2011 when 28nm was in production. Cost of R&D required for CPU and foundry process have gone up significantly since. Without a growing revenue base, there was no way Intel will have the cash flow to sustain investment in the foundry to achieve its 2030 goal.

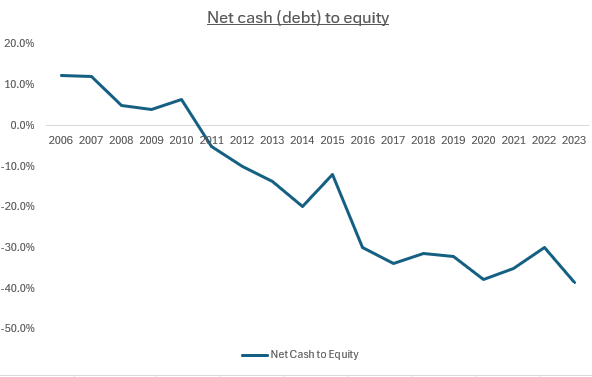

Given the ambitious plan, Intel should have removed dividend the moment there was buy-in on Pat Gelsinger. Free cash flow has turned negative to the tune of $15 billion a year. Leverage is now at 40% net debt to equity and multiple rating agencies have downgraded Intel’s bond this year.

Intel Corp. Ratings Placed On CreditWatch Negativ | S&P Global Ratings (spglobal.com)

Moody's Investors Service downgrades LT- local currency credit rating of Intel to "A3"

Supported by Chips Act money, Intel will not be a going concern. However, Intel certainly does not have sufficient resources to support the growth of both foundry and products. Moore’s Law is brutal, and it is the ultimate driver of this increasing return to scale business where the winner becomes bigger over time. Intel will achieve mass production of 18A, but this does not lead to any significant foundry business revenue. TSMC’s mass production of A16 in 2H 2026 will further erode the advantage of Intel’s Backside Power Rail.

Intel is underperforming on Mooris Chang’s 3 KPIs once again and the outlook is not bright given declining revenue, negative free cash flow and rising gearing. There is just no way out for Intel unless there is significant revenue growth in either its CPU product or the foundry business. Moore’s Law requires ever increasing investment and that is only possible if you have improving revenue & cashflow.

While not much, not having paid that dividend since Pat took over would make them a slightly better positoned.

Would you be kind enough to provide any reference/article title that I can use for Moris Chang's 3 KPI interview? Would like to watch/read the whole transcript or a summary of it, if possible.