TSMC Q2 results - Foundry 2.0

This has been a long time coming

A strong beat

Against expectation, TSMC delivered all that investors were looking for

9.5% QoQ growth in revenue in Q3

Higher gross margin despite N3 dilution

Wafer ASP grew by 24% YoY

Raise the low end of capex guidance from $28 billion to $30 billion

Raise the 2024 revenue growth to more than mid 20% vs low to mid 20%

N3 revenue was surprisingly strong in Q2 as it grew by more than 80% sequentially without the typical seasonality of iPhone launch. This was probably driven by the launch of MacBook Air and iPad Pro which were powered by M3 and M4 chips respectively.

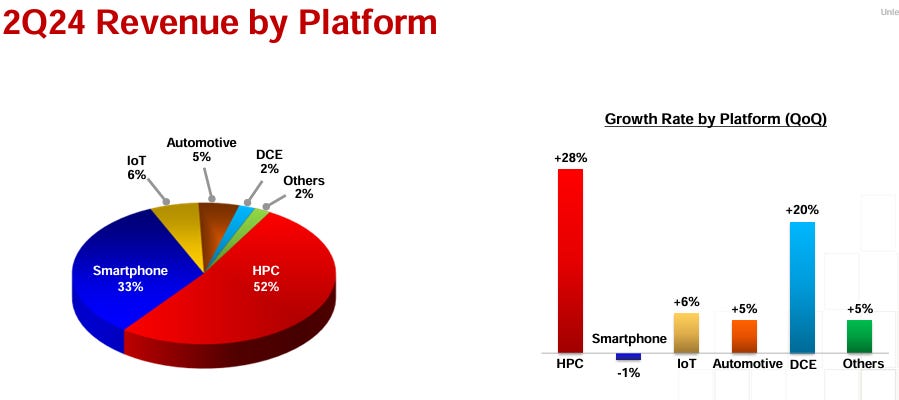

Hence, HPC accounts for more than 50% of TSMC revenue for the first time as HPC revenue grew 28% sequentially. This ratio will continue to go up over time with the ramp of Nvidia, ASICs and Intel’s PC CPU over the next few quarters.

Demand for N3 is so strong that TSMC has to continue to convert N5 capacity to N3 into 2025. Nvidia will be ramping next-generation Rubin at TSMC’s N3 at the end of 2025. Outsourcing ratio of Intel’s PC CPU will also rise into 2025.

TSMC is also benefiting from content growth in the AI smartphone and PC market. Both Qualcomm and MediaTek are migrating to N3 in 2H 2024. In addition, die size has also gone up by 5-10%.

Source: TSMC Q2 2024 Presentation

Price hike is coming in 2025, gross margin will surprise on the upside

TSMC’s CEO CC Wei hinted multiple times during the call that price hike is happening in 2025 as TSMC looks to sell its value. With the many comments during the call, it was almost certain that it is happening.

While customers like Nvidia have accepted the price hike, Apple has been pushing back. With demand exceeding their CoWoS capacity, TSMC will be raising pricing on its advanced packaging business to bring it closer to corporate average.

TSMC's pricing strategy is strategic, not opportunistic to reflect the value that we provide.

At the same time, we faced rising cost challenges due to increasing project complexity, a leading node, higher electricity costs in Taiwan, global fab expansion in higher cost regions and other cost inflation challenges. And therefore, we will continue to work closely with our customers to see our value.

I think the pricing is strategic. So it won't be flat for average product sector. So it will be different, okay? That all I can share with you. And all my customers, they are looking for leading-edge as a capacity for the next few years, and we are working with them. And so far, we try our best to support them, both in pricing and in capacity.

I'm working with our customer. As I said, this kind of pricing is strategic. And certainly, we want to sell our value. Changing the target in -- at this moment, I think I would like to emphasize 53% and higher, please put more attention to and higher. The number, I'm not going to change it at this time. When I have more conversation with my customer and discuss with them, and I probably will give you and higher portion, okay?

And then maybe also just Gokul asked if it's possible to get back to the high 50%, 60% level that we saw in 2022?

Jen-Chau Huang Senior VP of Finance & CFO: Yes, if we have a very high utilization rate, everything else stays the same, possible.

Source: TSMC Q2 2024 earnings call

There is plenty of upsides in gross margin for TSMC as we have seen in previous upcycle. Price hike, weak NTD and high utilization can drive the gross margin beyond the previous peak of 59.6% in 2022. Consensus gross margin of 53.6% in 2024 and 55.1% in 2025 is too low for an upcycle.

Foundry 2.0 - This has been a long time coming

At this time, we would like to expand our original definition of foundry industry to foundry 2.0, which also includes packaging, testing, mass-making and others and all IDM, excluding memory manufacturings. We believe this new definition better reflects TSMC's expanding addressable market opportunities in the future. However, I want to emphasize here that TSMC will only focus on the most advanced back-end technologies which help our customers in leading-edge product. Under this new definition, the size of the foundry industry was close to USD 250 billion in 2023 as compared to USD 115 billion under the previous definition.

Source: TSMC Q2 2024 earnings call

For longtime observer of TSMC, Foundry 2.0 merely confirmed the More than Moore’s trend that started in 2016 with the InFO (Integrated Fan-Out) for Apple’s A10. TSMC recognized the strategic value of advanced packaging to drive the advancement of Moore’s Law and has invested in it for more than a decade. TSMC’s leadership in advanced packaging has been an underrated source of competitive advantage.

Foundry 2.0 is TSMC taking market share from the OSATs; not because it wants to enlarge its revenue pool but for strategic reason to lock-in the customers. Apple has been single sourced at TSMC ever since InFO was done at A10 in 2016. This is inevitable as OSATs are unable to bear the losses from the yield rate of advanced packaging. TSMC has spent 2-3x the amount of capex for packaging as compared to ASE who is the largest OSAT in the world. For the OSATs, they have also been trying to take market share from the EMS players though SiP (Systems in Package). Because Foundry 2.0 is strategic, TSMC remains open to working with other OSAT partners.

Let me share with you as my customer moving into 2-nanometer or A16, they all need to probably take in the approach of chiplets. So once you use your chiplets, you have to use in advanced packaging technologies. On the edge AI, for those kind of smartphone customer, as compared with the HPC customers, HPC is moving faster because of bandwidth concerns, latency of footprint or all those kind of thing.

Source: TSMC Q2 2024 earnings call

With the death of SRAM scaling at N3, TSMC is now saying that all their N2 customers will have to adopt chiplet designs. Apple’s M5 server will adopt TSMC’s SoIC solution which involves hybrid bonding. With the line between front-end and back-end equipment becoming blurred, investors should pay more attention to companies such as BESI, ASMPT, Camtek and Onto.

Another long-term trend is that package size is getting bigger over time. With CoWoS-L, TSMC is able to provide packaging solution at 6x the reticle size. Blackwell is at 3.3x reticle size and we will only see it gets bigger to accommodate more GPU dies and HBM stacks. Bigger area = more power consumption. This is positive for demand for substrate, power supply and cooling.

Source: TSMC Technology Symposium