This week in semi (14th Apr) - Hybrid Bonder, Alchip

Hanmi Semiconductor wins 22.6 billion won order from Micron.

Hanmi will supply TCB (Thermo Compression Bonder) to Micron for HBM, suggesting likely HB (Hybrid Bonder) adoption after 2026.

Not a surprise after JEDEC relaxation. K&S and ASMPT are working on next-generation TCB that can approach 10-micron in bump size.

Memory is still the bigger opportunity for BESI in HB and HB is the eventual roadmap for all things HPC related. The longer it takes for HB adoption, the higher the chance that competitor like ASMPT can gain share.

Alchip under pressure

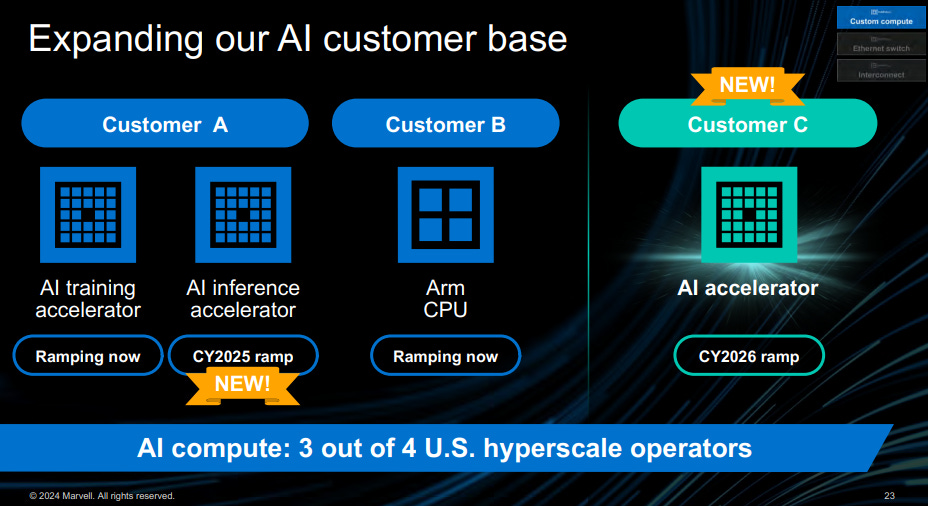

Marvell won Trainium and Inferentia Gen 2.5 from Alchip. This was why Alchip said AWS will ramp down in 2025 due to migration issue.

2025 production revenue for Alchip is now reliant on Gaudi 3. Gaudi 3 was a disappointment, and it is on HBM2e. Too little, too late given Nvidia's product cadence and the strong TCO advantage of the highly integrated GB200. Hyperscalers are not incentivized to take on another merchant silicon given the lack of power. They are left with a bunch of Tier 3 customers: Bharti Airtel, Bosch, CtrlS, IBM, IFF, Landing AI, Ola, NAVER, NielsenIQ, Roboflow and Seekr.

Socionext won the Meta CPU project according to Morgan Stanley. Another potential new entrant in the HPC custom silicon space. Alchip is not a partner in the ARM Total Design ecosystem, and this could be a reason.

Longer term, the question remains what the moat for ASIC design house is unless you are Broadcom which has top tier SerDes IP. More competition is entering from Taiwanese fabless such as Mediatek, Realtek and Novatek. Most of the ASIC projects are sub-par too.