Taiwan's High Yield ETF

Inside the retail yield chase that’s reshaping Taiwan’s equity market

Introduction

Taiwan’s exchange-traded fund (ETF) market has exploded as total ETF assets jumped 55% YoY to USD 196 billion in 2024 and now account for about 2/3 of all onshore fund assets. According to Financial Times, ETFs only accounted for 27.5% and 56.7% of the public fund industry assets in 2018 and 2023 respectively.

It is important to understand the ETFs given the sizable impact they can have on the market. An example will be the deletion of MediaTek from Capital Tip Customized Taiwan Select High Dividend ETF (00919 TW) last week. MediaTek was a 9.67% holding in the 00919 ETF but was deleted from the index on 4th June 2025. 00919 had to sell 27 million shares of MediaTek or close to 2% of total outstanding shares of MediaTek.

Source: Nomad Semi

This creates an opportunity for buyers as the ETF is a forced seller regardless of fundamentals or fair valuation. MediaTek underperformed the market by 4% from 4th to 5th June before the ETF selling pressure eased off subsequently. If you had bought at the bottom on 5th June, you would have made 8% in just 4 trading days.

Source: Google Finance

The Rise of High Yield ETF

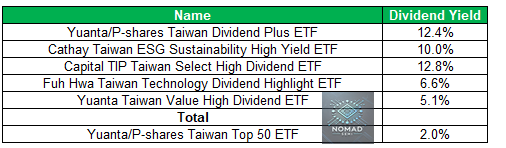

The ETF market in Taiwan boomed last year with the popularity of the high dividend yield ETFs. Notably, there are 5 big high yield ETFs which have a total asset of NTD 1.57 trillion or USD 52 billion. The combined AUM of these 5 high yield ETFs is 2.5x bigger than the flagship Taiwan Top 50 ETF which is based on the Taiwan 50 Index. They also rank among the most traded securities every day.

Source: Nomad Semi

To get a sense of how popular they are, we can also look at the total number of shareholders for the ETFs. Taiwan stock market has 13 million investors, of which 1.75 million owns Cathay Taiwan ESG Sustainability High Yield ETF and 1.47 million owns Yuanta/P-shares Taiwan Dividend Plus ETF. This is just a little below the 1.79 million shareholders for TSMC.

Source: TDDC

1 unique feature of these high yield ETFs is that they do not own TSMC, which is 56% of the Taiwan 50 Index and close to 40% of total Taiwan market capitalization. Many retail investors already own TSMC shares (1.75 million local investors) or through the Taiwan Top 50 ETF.

These ETFs offer retail investors non-TSMC exposure in Taiwan with a high dividend yield. The 3 most popular high yield ETFs are Yuanta/P-shares Taiwan Dividend Plus ETF, Cathay Taiwan ESG Sustainability High Yield ETF and Capital TIP Taiwan Select High Dividend ETF. These 3 high yield ETFs with a combined AUM of USD 42.5 billion offer quarterly distribution with an annual dividend yield of more than 10%. While Fuh Hwa Taiwan Technology Dividend Highlight ETF and Yuanta Taiwan Value High Dividend ETF dividend yield is much lower than the former 3, they offer monthly distribution payout.

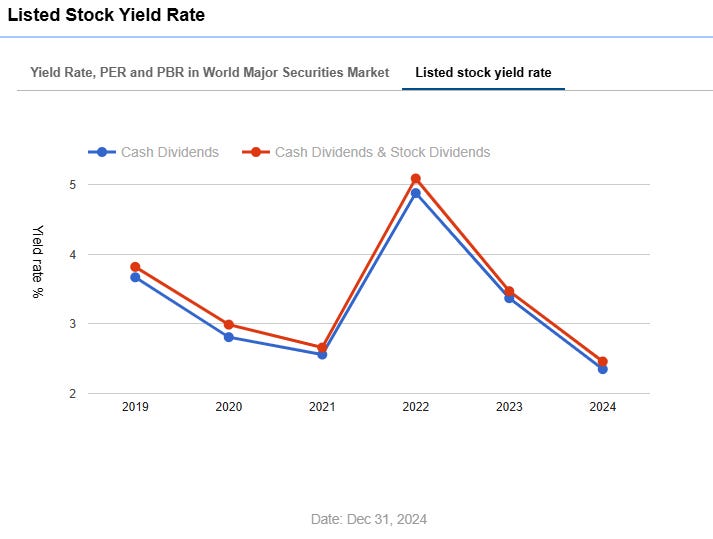

High Payout Ratio in Taiwan

Taiwan companies often have high payout ratio regardless of whether the companies are in the semiconductor, financials, retail or traditional industry.

Source: TWSE

There are multiple reasons for these shareholder friendly actions. The most important reason is Taiwan’s addition 5% profit retention tax on any earnings not distributed by the end of the following year. This creates a healthy hurdle rate for Taiwanese companies when evaluating whether they should distribute excess cash as dividend or to keep them on balance sheet or for expansion opportunities. In addition, Taiwanese companies often have healthy balance sheet and stable cash flow without the need to frequently access the capital market (ODMs didn’t used to have to raise money). Insurance companies are also significant source of domestic institutional funds.

Stock Selection Methodology

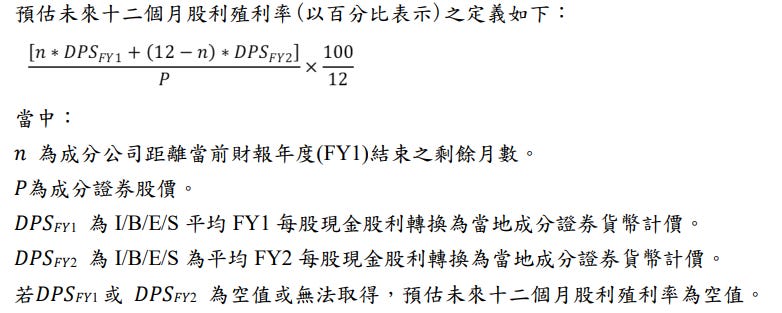

To understand how they decide on inclusion and deletion, we can look at the methodology for Yuanta Taiwan Dividend Plus ETF.

The universe starts from the top 150 stocks in Taiwan (Taiwan 50 and Taiwan Mid-Cap 100 Index)

The market cap is then adjusted for to ensure it meets 5% free float requirement, which is what they deemed to be available for public trading. Government, founder, family, management and strategic investors holdings are often excluded from free float

The Index then takes the top 50 stocks ranked by their next 12 months forecasted cash dividend yield. The forecast is taken from Institutional Brokers Estimate System and relies on forward estimates.

Semi-annual reconstitution is done in June and December. A limit is placed such that no single name is more than 6% of the Index or that the Index will own more than 15% of the investable market cap.

Source: Yuanta

How Significant are They?

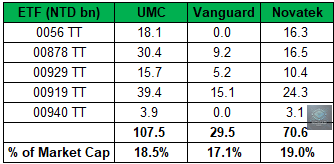

The reason why I wrote this article is that these high yield ETFs are becoming major market movers. The AUM of these 5 high yield ETFs accounts for 3.6% of the total non-TSMC market capitalization in Taiwan. At the individual stock level, they often pose much higher concentration risk given they only hold 30-50 stocks.

In particular, they account for close to 20% of total share outstandings of certain semiconductor stocks such as UMC, Vanguard and Novatek. All 5 high yield ETFs own UMC due to its attractive 6% dividend yield. The NTD 107.5 billion holdings in UMC is equivalent to 18.5% of UMC’s total market capitalization.

For Vanguard International Semiconductor, 3 ETFs own 17% of Vanguard’s total market capitalization. The influence of ETFs is even more significant for Vanguard considering that TSMC owns 27% and National Development Fund owns 16% of the company. This implies that 3 ETFs own 1/3 of the available free float and that any deletion decision will be executed within a week. Share price of both companies will also be influenced by inflow and outflow of the AUM of these ETFs.

Another implication of the high yield ETFs is that there is certain downside support for any high dividend yield stocks in Taiwan. As share price falls and dividend coupon is fixed, dividend yield will go up which could lead to inclusion in the index and ETFs. Conversely, when shares get expensive the ETFs could remove the company from the index.

Conclusion

While Taiwan’s dividend ETF craze has democratized access, it has also rewired the market micro-structure and shifted price discovery from fundamental research to rulebooks. For semiconductor investors in Taiwan, understanding where passive flow goes and reverses can provide tactical allocation edge. Stay nimble and never forget that these ETFs can both distort and support the valuation of the underlying stocks.

Agree. It goes a long way to instill capital discipline in the company

I’m not an ETF investor, but this article does an awesome job laying out Taiwan’s ETF scene, especially how big these high-yielders are as a slice of a company’s free float. It’s wild to see that a share price bump can kick a stock out of an index (and a slump can force it back in), purely because of some rulebook rather than fundamentals.

That dynamic creates real market quirks: forced buying or selling that has nothing to do with a company’s true value. For active investors, those distortions are gold for capturing alpha, whether you’re swooping in on the “dumb” sell-offs or riding the rebound.