MediaTek Deep Dive

Underrated Asian Fabless in Partnership with NVIDIA to Take on the Future of AI, Auto and PC

Introduction

MediaTek, headquartered in Hsinchu, Taiwan, is a leading fabless semiconductor company specializing in the design of smartphone system-on-chip (SoC). MediaTek has grown to become the world's fifth largest fabless semiconductor company, powering over 2 billion devices annually.

The company's product portfolio encompasses a wide range of applications, including mobile devices, home entertainment systems, connectivity solutions, and Internet of Things (IoT) products. MediaTek's SoCs are integral to smartphones, tablets, smart TVs, routers, and various smart home devices. Notably, its Dimensity series has positioned MediaTek as a significant player in the 5G smartphone chipset market, offering high-performance solutions at competitive price points. The company is embarking on its next growth phase as it expands its TAM through PC, automotive and AI ASIC.

Table of Content

Founder Tsai Ming-Kai - Godfather of Chip Design

The history of MediaTek cannot be separated from its founder Tsai Ming-Kai, who is also known as the Godfather of Chip Design in Taiwan. Born in 1950 in Taiwan, Tsai Ming-Kai graduated from National Taiwan University with a degree in electrical engineering, later earning a master's degree from the University of Cincinnati in Ohio.

Source: Forbes

Tsai began his career at the Industrial Technology Research Institute (ITRI), where he led the microcomputer IC design department. ITRI, a government backed research institute established under then Minister of Economic Affairs Sun Yun-suan, played a pivotal role in Taiwan’s industrial development and was instrumental in the creation of spin-offs such as TSMC.

In 1976, ITRI signed a technology transfer license agreement for CMOS technology with Radio Corporate of America (RCA). ITRI sent a group of engineers to RCA for training in semiconductor. This group of engineers included Robert Tsao, founder of UMC; Tsai Ming-kai, founder of MediaTek and F.C. Tseng, a key lieutenant when TSMC was founded.

Subsequently, Tsai joined UMC in 1983 to form the IC design group as UMC wanted to increase their fab utilization rate through internal IC products. He was promoted to President of UMC’s product business units, where he directed the company’s efforts in storage, CPU, consumer electronics, and multimedia chip development. Tsai’s 15 years at UMC allowed him to grow from an engineer into a businessman.

A decision was made by UMC to transform into a pure-play foundry in 1995, which led to the spin-off of multiple design subsidiaries such as Novatek, AMIC, ITE Tech, Davidcom, Faraday and MediaTek. Both MediaTek and Novatek are among the world’s top 10 biggest fabless companies. Tsai chaired and managed many of these design houses that were spun out of UMC.

Tsai has a strong interest in strategy, often drawing inspiration from Michael Porter and Andy Grove. His keen strategic sense has been a key factor behind Mediatek’s success as Asia biggest fabless company.

One key insight is that fabless design has a lower barrier of entry

IC design doesn’t need to be cutting-edge; meeting market needs is what defines a successful design

History of MediaTek - Transformation and Adaptation

Spun out in 1997, MediaTek was known as the most promising design subsidiary of UMC. MediaTek's decoder ICs for CD-ROM and DVD-ROM had high barriers to entry and captured over 80% of Taiwan’s CD-ROM market.

Former Chairman of TSMC Mark Liu said “Tsai Ming-Kai, the founder of MediaTek, has been able to re-invent MediaTek time and again with new business models to turn challenges into opportunities in the unpredictable and fast-moving technology industry.”

Entry into mobile phone market - A tumultuous journey for 3G and 4G

In 2000, MediaTek evaluated the mobile phone chip industry and felt it would be a critical growth area for the company. A major investment was made and MediaTek started to produce chipset for 2G feature phones in 2004. Tsai pioneered a turnkey solution that bundled hardware and software for feature phone chipsets, which dramatically lowered entry barriers for handset manufacturing. His strategic insight was to remove friction for system makers and own the ecosystem. This strategy enabled a wave of low-cost “Shanzhai” (white-box) phones in China, making MediaTek the dominant supplier of feature phone SoC during that era.

The next evolution came when the mobile market shifted from 2G feature phones to 3G smartphones. This period was challenging as Qualcomm’s lead in 3G (as the inventor of CDMA technology) meant MediaTek lagged initially. MediaTek spent a few years catching up before securing 45% market share (+29% YoY) in China smartphone market in 2012.

A similar issue happened again in 2014 with China’s adoption of LTE. Back in 2009, Taiwan’s government was backing the WiMAX standard for 4G, but the global market ultimately coalesced around LTE. MediaTek, initially aligned with WiMAX, found itself two to three years behind when it pivoted to LTE, delaying its chip rollout and leading to more than 20% market share loss between 2015 and 2017. Another strategic misstep was to go after the high-end segment when MediaTek is known to only have cost competitiveness in the later part of the cycle.

Source: MediaTek

ex-TSMC CEO Rick Tsai was hired in 2017

Tsai Ming-Kai later acknowledged the strategic misstep and made the decisive call to wind down the 4G project ahead of schedule, swiftly reallocating resources toward 5G R&D. Determined to avoid falling behind again, MediaTek set its sights on becoming a technological and commercial leader in the next generation of wireless.

At the same time, Tsai Ming-Kai hired ex-TSMC CEO Rick Tsai to become the new CEO of MediaTek. For those who are not familiar with the history of TSMC, Rick Tsai was the initial successor of Morris Chang in 2005 before Morris Chang came back to reclaim the CEO role in 2009. Contrary to public perception, Rick Tsai was still Morris Chang’s most preferred successor after the layoff saga.

Source: Computex

Tsai Ming-Kai acknowledged that MediaTek has grown too big and enlisted Rick Tsai in 2017 to impose operational discipline on the company. Rick Tsai also recognized the need to bet big on 5G early so that it does not lose out to Qualcomm early in the cycle transition.

When 5G adoption came in 2020, MediaTek was able to release the Dimensity series, a cost-competitive 5G SoC, that was earlier than Qualcomm. This is the 1st time since the botched 3G and 4G transition that MediaTek is neck-to-neck in competition with Qualcomm. The success of the 5G transition can be seen from MediaTek’s share price which appreciated more than 500% from 2019 to 2021.

Source: Google Finance

With 5G adoption maturing and the smartphone market reaching saturation, MediaTek has begun seeking new growth drivers. In the coming years, the company is poised to expand into new markets and applications, marking the next phase of its growth journey. We will explore these new initiatives later in the deep dive.

Revenue Overview

3 main product groups of MediaTek

Mobile phone SoC is the core business of MediaTek, accounting for 60% of its total revenue

Smart Edge is a diversified portfolio of chips for the edge such as wireless connectivity (Wi-Fi, Bluetooth), Digital TV and Set Top box, Edge AI, IoT and ASIC design solution

Power IC focuses on power management IC (PMIC), most of which came from the acquisition of Richtek in 2015

1) Mobile Phone

MediaTek’s Helio and Dimensity (5G) SoC power smartphones across tiers, especially Android devices. MediaTek is the leading supplier of smartphone SoC by unit volumes thanks to its strength in mid-range and value smartphones. Many feature phones today are also still powered by MediaTek.

SoC is the brain of a smartphone as it integrates multiple components such as CPU for running the OS and processing, the GPU for rendering images and videos, memory controllers, modems for cellular connectivity, and other functions such as the ISP. By combining these elements into one compact chip, SoCs enable smartphones to be powerful and energy-efficient, handling everything from running apps to connecting to networks and processing multimedia content.

Source: Fonearena, Dimensity 9200

Processor technology is largely licensed from ARM Holdings and MediaTek is required to pay a royalty fee to ARM for every smartphone SoC they sold. ARM dominates the smartphone SoC market, with its architecture powering over 99% of mobile devices globally. This dominance stems from ARM's energy efficient designs, which are crucial for battery-powered devices like smartphones. The widespread adoption of ARM's architecture ensures broad compatibility across applications and operating systems, facilitating a seamless user experience and simplifying development for software engineers. On the other hand, the x86 architecture dominates the PC and server CPU market.

In the past, Qualcomm used to have an internal R&D team that was licensed to improve the ARM architecture. However, this is less important these days given that ARM has gotten really good at it.

The key differentiation for smartphone SoC lies in the die size and the modem technology for cellular connectivity. Die size determines the cost structure and the power consumption of the smartphone SoC. Higher power consumption is frowned upon due to the limited battery life of a smartphone. Modem or the baseband processor plays a crucial role in ensuring effective and efficient communication over wireless networks by processing baseband signals, which are the raw signals ready for transmission or received after being converted.

For MediaTek’s Dimensity 9400 SoC which is built on ARM V9.2 architecture, MediaTek licensed Cortex CPU and Immortalis GPU IP from ARM. NPU 890, ISP Imagiq 1090, Display MiraVision 1090 and the modem technology are designed by MediaTek. NPU is neural processing unit which allows smartphones to handle AI inferencing requirement.

Source: notebookcheck, Dimensity 9400

Overview of the smartphone SoC market

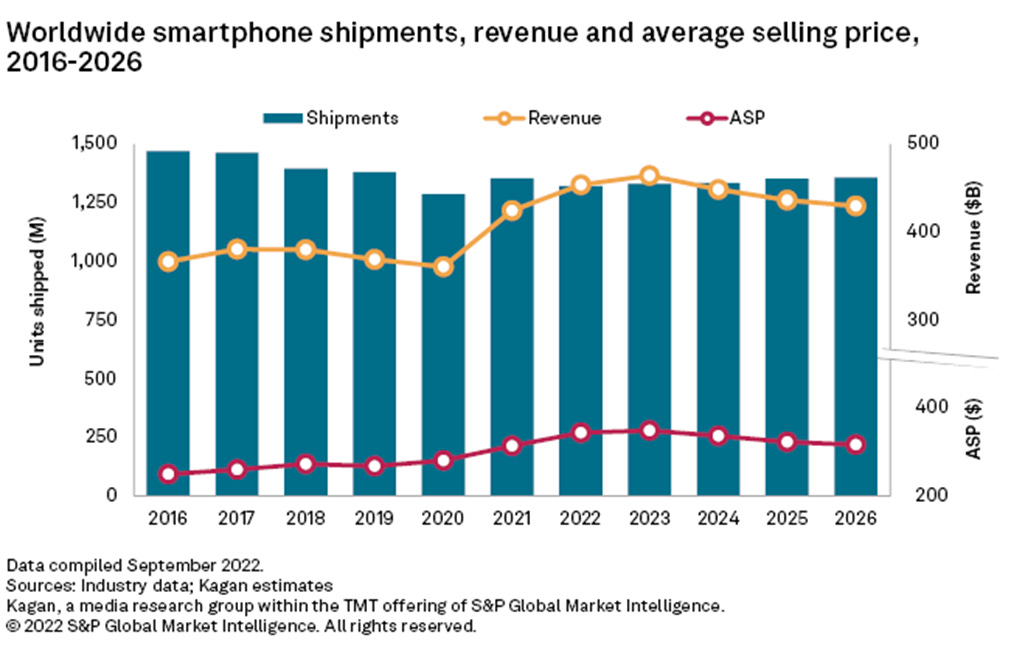

Global smartphone unit shipment peaked at 1.5 billion units in 2016 and has been on a slow decline since. Global smartphone unit shipment was 1.2 billion units in 2024 and is likely to remain at similar level given high smartphone penetration rate and a slower replacement cycle. Smartphone growth is available only in certain regions such as Africa and India where smartphone penetration rate remains at below 50%. Replacement cycle is getting longer due to the lack of significant new innovation for smartphone.

Source: S&P Global

The smartphone SoC market can be split into 2 segments: merchant silicon and in-house custom silicon. Merchant silicon vendors, such as Qualcomm and MediaTek, supply SoCs to a broad range of smartphone OEMs like Xiaomi, Oppo, Vivo, and Samsung. Conversely, in-house custom silicon is developed by companies like Apple, which designs its own A-series chips for iPhones exclusively, and Samsung, which produces Exynos chips for select models. In-house custom silicon makes a lot of sense for Apple given its control of the iOS ecosystem and ability to optimize the iPhone. While Apple is still using Qualcomm’s modem for its iPhone SoC, this is set to change as iPhone 16e has started to use Apple’s in-house modem C1.

The trend in the last 5 years has been a shift towards merchant silicon as Huawei was put on entity list (banned from accessing TSMC’s technology in 2020) and Samsung was unable to deliver on its foundry process technology. For Galaxy S25, Samsung decided to use Qualcomm Snapdragon Elite 8 exclusively for the second time in recent years. While Oppo had tried to design their in-house chipset in 2019, they shut down the Zeku division in 2023.

Source: Counterpoint

Source: IDC, MS

For the merchant silicon market, it is largely dominated by Qualcomm, MediaTek and UNISOC from China. The turning point for MediaTek was in 2020 when 5G first took off in volume. As explained earlier, MediaTek was early to invest in 5G technology and it’s 5G chipset was no longer inferior to Qualcomm. In addition, MediaTek was in a better position during the period of chip shortage in 2021 due to a better relationship with TSMC. Back then, Qualcomm was trying to dual source between TSMC and Samsung which did not end up well for Qualcomm.

Post the 5G cycle, MediaTek’s volume share is relatively stable and it started to target the premium market with Dimensity 9000 series. It is not easy to target the premium market in China as consumers often have the impression that Snapdragon-powered phone is better than MediaTek’s. With an improved chipset and the OEMs facing cost pressure in a stagnant smartphone market, MediaTek’s Dimensity 9000 series was able to achieve $1 billion in revenue in 2023 and $2 billion in revenue in 2024. Powered by TSMC’s 3nm technology and Arm V9 architecture, MediaTek’s Dimensity 9400 is almost on par in performance with Qualcomm’s Snapdragon 8 Elite. The ASP of Dimensity 9400 is more than $100, which is several times more than the average 5G chipset.

Source: Antutu

Source: Counterpoint

Moving forward, smartphone SoC is a stable cash cow for MediaTek given stagnant smartphone market growth and limited market share gain opportunity. MediaTek will have to wait for AI smartphone or 6G to take off before its smartphone SoC revenue can resume its growth momentum.

2) Smart Edge

MediaTek has a wide range of product portfolios for the smart edge. We will first look at the more mature segments before moving to the new growth initiatives.

Digital Television and Display SoCs

MediaTek is the world’s leading supplier of chips for smart TVs, digital TVs, and set-top boxes. The MStar merger in 2012 made MediaTek dominant in this segment. Its SoCs service smart TV (for brands like Sony, Sharp, Xiaomi, etc.), handling tasks from video decoding and upscaling to app execution. These chips often integrate display controllers, audio processors, and connectivity. MediaTek’s TV chip business is a stable cash cow given the mature TV markets.

Connectivity: Wi-Fi & Bluetooth

MediaTek is a major player in connectivity chips. The 2011 acquisition of Ralink gave it a strong foothold in Wi-Fi routers and combo chips for devices. Today, MediaTek’s Filogic line covers Wi-Fi 6/6E and Wi-Fi 7 solutions for routers, broadband gateways, and IoT devices. It also produces Bluetooth and GNSS (GPS) chips often used alongside its smartphone SoCs or in standalone applications (e.g. wireless earbuds, wearables). This business benefits from the global demand for wireless connectivity in smartphones, PCs, smart home gadgets and industrial IoT. Boosted by the transition to Wi-Fi 7, MediaTek expects its Wi-Fi revenue to double this year as the ASP of Wi-Fi 7 SoC is more than double of Wi-Fi 6/6E.

Source: Lite-point

New Growth Drivers: PC CPU, Automotive, ASIC

ARM-based PC CPU

MediaTek has significantly expanded its presence in the Chromebook market through its Kompanio series processors. The Kompanio 500 series, including the Kompanio 520, powers affordable Chromebooks like the Lenovo 100e Gen 4 and ASUS CM14. MediaTek’s Kompanio Ultra 910, marks a significant leap in Chromebook capabilities. Built on a 3nm process, it features an all-big-core CPU architecture, an 11-core GPU with ray tracing support, and an 8th-generation NPU delivering up to 50 TOPS of AI performance.

According to the Market Data Forecast, the Chromebook market is expected to grow at 3.5% CAGR from 2025 to 2033. This is propelled by increasing demand for affordable, cloud-centric computing solutions across education, enterprise, and personal use sectors. MediaTek is currently the No 1 ARM-based Chromebook CPU provider and will continue to take share from Intel, which is the leading x86 CPU provider for the Chromebook market.

Source: MediaTek

In middle of 2024, Qualcomm officially released Snapdragon X Elite chip for Windows on ARM (WoA) PCs. Given that Qualcomm’s exclusivity agreement with Microsoft had ended late last year, MediaTek is expected to announce its ARM-based CPU over the next few months. This ARM-based CPU is designed in collaboration with NVIDIA and MediaTek is expected to receive royalty fee from it.

ARM-based PCs offer notable advantages, particularly in power efficiency and thermal management, making them ideal for notebook and extended battery life scenarios. These attributes have led to their widespread adoption in mobile devices and are increasingly influencing the laptop market. However, ARM-based PCs still face challenges, notably in software compatibility, as many applications are optimized for x86 architectures. With increasing competition from ARM-based vendors such as Qualcomm, MediaTek and Apple, this is a structural headwind for Intel in an increasingly crowded market.

In January 2025, NVIDIA released GB10 Grace Blackwell Superchip for NVIDIA Project DIGITS in collaboration with MediaTek. This is a personal AI supercomputer designed for the public to gain access to high performance AI computing. Although the GB10 is priced at $3000, the revenue contribution will be limited for MediaTek as the main GPU and CPU designs come from NVIDIA.

While PC CPU is a new market for MediaTek, it will not be a significant driver of the long-term value of the company. The PC CPU TAM is $30 billion and profitability may not be high in a crowded market. Assuming MediaTek can capture 10% of the CPU market in the long-term, revenue contribution is $1.5 billion at best as there is revenue sharing with NVIDIA. This will represent 10% of MediaTek’s revenue in 2024.

Automotive

MediaTek launched its Dimensity Auto platform in April 2023 to enter the infotainment SOCs market. This platform aims to provide infotainment SoCs, telematics, connectivity solutions and eventually ADAS chips for vehicles.

Qualcomm had a head-start here with a $45 billion design-win pipeline as of 2024, but MediaTek is leveraging partnership with NVIDIA to catch up. As Qualcomm pushes deeper into the autonomous driving space with the Ride Platform, the partnership between NVIDIA and MediaTek is highly complementary and strategically beneficial for both. NVIDIA leads in autonomous driving with its powerful ORIN GPU platform, while MediaTek brings strength in modems and infotainment which are key capabilities required to secure cockpit design wins. The partnership is necessary to go up against Qualcomm which is getting more embedded within the automotive semiconductor market.

Source: Qualcomm Investor Day 2024

At the recent Automobile Shanghai show, MediaTek has unveiled its flagship Dimensity Auto Cockpit Platform (C-X1) marking a significant milestone in its collaboration with NVIDIA. This C-X1 SoC is fabricated on TSMC's N3 process and integrates an NVIDIA Blackwell GPU, bringing advanced ray tracing and AI capabilities to the automotive cockpit. It also supports 5G technology, complying with 3GPP Release-17 and Release-18 standards.

Source: MediaTek

In Q2 2023, the company reported over $1 billion in automotive design wins with revenue starting to ramp in 2026. This has the potential to be a much bigger market than both PC CPU and smartphone SoC market. In Qualcomm Investor Day 2022, they had estimated a TAM of $100 billion for the automotive market by 2030 based on connectivity, cockpits and autonomous driving solutions. While EV adoption might have hit a bump, there is no question that cars continue to get smarter.

Source: Qualcomm Automotive Investor Day 2022

If MediaTek is able to capture 10% of the automotive infotainment and connectivity market, this will be $4 billion in incremental revenue or 25% of its 2024 sales. While the automotive push takes time to realize revenue due to the longer qualification cycle, it is stickier as carmakers tend to use a chip platform for many years.

AI ASIC

Hyperscalers like Google, Amazon, and Meta are increasingly developing their Application-Specific Integrated Circuit (ASIC) for AI acceleration, networking, and specialized workloads. Broadcom had estimated an AI SAM of $60- 90 billion from its 3 customers by 2027. There are a few reasons why investment in ASIC will continue

FAMG have the scale to invest in their custom silicon

They can lower cost of ownership in cost-sensitive AI applications by paying lower than 70% gross margin to design service provider

Custom silicon acts as a negotiation tool against the dominance of NVIDIA in the GPU space. They are also useful when NVIDIA’s GPU delivery schedule is delayed

For internal workloads, hyperscalers are able to optimize both the software and hardware through the control of their in-house ASIC

MediaTek, with its broad silicon design expertise, sees an opportunity to serve as a design and manufacturing partner for these ASICs projects. They had past experience working on both consumer and enterprise ASIC projects with customer such as Cisco and game consoles provider.

The company is working with Google to develop the next generation of its Tensor Processing Unit (TPU) AI chips. Google has traditionally worked with Broadcom on TPU, but is turning to MediaTek for cost advantage and supply chain diversification effort. With its strength in Serializer/Deserializer (SerDes), Broadcom is known to charge a gross margin as high 70% for the TPU project.

MediaTek expects to recognize revenue from the N3 TPU 7e project starting from 2026. Revenue contribution is expected to be a few billions given that Google is estimated to have spent $6 to 9 billion on TPU 5 in 2024. MediaTek is also likely to be featured in the next-generation N2 TPU 8e project.

The main advantages of MediaTek in the ASIC market lie in its SerDes capabilities and close relationship with TSMC. SerDes (Serializer-Deserializer) IP is an analog IP that is a cornerstone for next-generation ASIC designs as it enables ultra-high speed data transfer. SerDes converts parallel data into serial data (a single high-speed data stream) for transmission, and converts it back to parallel data at the receiving end.

To support 1.6T networking, AI accelerators will require 224G SerDes (224 gigabits per second) over 8 lanes. While lower speed SerDes may be used, this will increase the number of lanes and hence power consumption. Broadcom, MediaTek and Synopsys are known to have credible 224G SerDes IP. For Broadcom, its strength in SerDes is the main reason why Google has to pay a very high gross margin for the TPU project. According to Irrational Analysis, MediaTek’s 224G SerDes has improved significantly. Having in-house SerDes also leads to cost saving as design service provider does not have to pay license fee to 3rd party IP vendors such as Synopsys or Cadence.

Source: IPnest

Another advantage of MediaTek in this market is its close relationship with TSMC. As one of the biggest customers of TSMC, MediaTek receive better pricing and wafer capacity allocation.

Lastly, it was also announced at GTC 2025 that MediaTek will integrate NVIDIA’s NVLink IP into its ASIC design service. This is yet another sign of a very close partnership between MediaTek and NVIDIA.

In November 2024, MediaTek took a stake in Taiwan design service provider Alchip. This could pave the way for future partnership where MediaTek can work on the front-end part of the design before passing the back-end chip design to Alchip.

One caveat for this business is that gross margin is lower than MediaTek’s corporate average of 48%. At the operating margin level, the margin dilution is not as high as bulk of the engineering expenses have occurred at the NRE stage. Another issue is that ASIC projects are known to face delay due to rising complexity or lack sufficient performance level to achieve mass production. For MediaTek, the TPU project was expected to contribute revenue in 2025 but has since been pushed back to late-2026. In addition, MediaTek is also in the running for some involvement in the next-generation Maia project by Microsoft.

Source: SemiEngineering

3) PMIC

In 2015, MediaTek acquired Richtek Technology, Taiwan’s leading analog IC company. Richtek initially focused on motherboard PMICs, but over time shifted its end applications toward mobile devices as the market evolved. Main product is power management chips that regulate voltages and battery charging in smartphones and laptops. These PMICs are often bundled with its SoCs (in reference designs for phone makers) and sold to 3rd parties. This vertical integration helps optimize device power consumption and gives MediaTek a larger share of the silicon content in devices.

Disciplined Capital Allocation and Capital Return

MediaTek has built a strong track record of generating attractive returns on its investments. Both MStar Semiconductor and Richtek Technology have become integral parts of MediaTek’s core business. Notably, MediaTek successfully doubled Richtek’s sales within five years of completing its acquisition, demonstrating effective integration and growth execution.

In 2011, MediaTek invested approximately US$20 million for a 20% stake in Goodix Technology, a Chinese company specializing in fingerprint sensors. Upon exiting the bulk of its investment in Goodix, MediaTek realized an impressive investment gain exceeding US$1 billion.

Similarly, in May 2016, MediaTek sold AutoChips to Chinese digital map provider NavInfo for US$600 million. This marked a more than 100% return on its investment, just three years after initially investing in AutoChips in 2013. These successes highlight MediaTek’s disciplined approach to capital allocation and its ability to unlock value across different segments of the semiconductor ecosystem.

Currently, MediaTek still have 3 publicly listed companies as their golden goose.

66.4% stake in Airoha Technology (6526 TT)

Airoha is a market leader in Bluetooth and Global Navigation Satellite System (GNSS) chipset. It is also in the midst of sampling 100Gbps PAM4 DSP in 2025.

MediaTek first invested in Airoha in 2007 before MediaTek bought out the remaining 75% stake for NT$5 billion (US$166 million) in 2017. Their stake in Airoha is currently worth NT$57.4 billion (US$1.78 billion), a return of more than 10x in 8 years.

28.8% stake in SigmaStar (301536 CH)

SigmaStar is a leading provider of video surveillance chip in China. This is a spin-off from Mstar which they acquired in 2012.

Their stake in SigmaStar is worth RMB6.7 billion (US$920 million).23.55% stake in Vanchip (688153 CH)

Vanchip is a leading domestic suppliers of power amplifiers in China.

Their stake in Vanchip is worth RMB3.1 billion (US$424 million). MediaTek first acquired the 40% stake in Vanchip for US$40 million in 2019. Another 10-bagger winner for MediaTek in just 5 years.

As a fabless semiconductor company, MediaTek operates with an asset-light model that generates strong free cash flow, enabling consistent shareholder returns. Reflecting this financial strength, MediaTek has maintained a generous dividend policy. In 2021, the company increased its dividend payout ratio to 80–85% of earnings, reinforcing its commitment to returning capital to shareholders.

Alongside this, MediaTek announced a special dividend of NT$100 billion (equivalent to NT$15 per share), distributed over the period from 2021 to 2024. This special dividend was funded from excess cash balance, showcasing the company’s robust balance sheet and confidence in its long-term cash generation.

Financials

As mentioned earlier, the 5G cycle was a big success for MediaTek. Their revenue more than doubled from 2019 to 2022 and net income grew by 500% in that period. In 2022 and 2023, inventory correction and charges took a hit on their bottom line during the semiconductor downcycle. Moving forward, consensus estimates expect MediaTek to grow its earnings by close to 50% from 2024 to 2027.

MediaTek has also proven its ability to maintain its margin at a high level 5 years after the initial 5G adoption. Given that Qualcomm does not have a cost advantage over MediaTek, we do not expect a price war. The company generates plenty of free cash flow each year and pays a big portion of it as dividend.

Risks

1. Xiaomi’s In-House Custom Silicon Development

Following the footsteps of Apple and Samsung, Xiaomi has signaled intentions to internalize key component like smartphone SoC to better differentiate its products. This is likely to have a bigger impact on Qualcomm. Rumor is that the in-house 4nm SoC “Xuanjie” or “XRing” will be released in 2025 although it is a generation or two behind the merchant silicon. Xiaomi is likely to rely on external modem provider for this SoC. This trend toward vertical integration among top smartphone OEMs could pressure MediaTek’s unit volumes over time.

2. Lag Between New Growth Drivers and Revenue Contribution

MediaTek’s diversification into automotive (Dimensity Auto), PC (Windows on Arm CPUs), and custom ASICs (hyperscaler partnerships) offers promising long-term growth, but these segments have long design cycles and gradual ramp-ups.

Automotive chips, for example, require stringent qualification processes and can take 3–5 years from design win to meaningful revenue contribution. Similarly, cloud ASICs is still in early stage and may not scale materially until 2026 or later. While MediaTek’s smartphone business is maturing, new drivers may take time to offset the cyclicality and slower growth in the core mobile segment, potentially leading to near-term growth volatility.

3. China Smartphone Subsidy

The Chinese government’s subsidy has created pull forward demand for consumer electronics such as smartphone. Historically, subsidies to stimulate domestic demand have led to demand distortions and inventory volatility in the supply chain. MediaTek is vulnerable to inventory correction once subsidies fade given their heavy exposure to Chinese OEMs.

Source: Counterpoint Research

Conclusion

MediaTek’s journey from a CD-ROM chipset maker to Asia’s largest fabless semiconductor company is a testament to its adaptability and strategic foresight. Under the leadership of Tsai Ming-Kai and Rick Tsai, the company has consistently navigated market transitions. It has captured leadership in smartphone SoCs and expanded into adjacent markets like connectivity and PMIC.

As 5G matures and smartphone growth plateaus, MediaTek is positioning itself for its next chapter by targeting automotive, AI ASICs, and ARM-based CPUs. While these new initiatives present long-term growth opportunities, they come with extended design cycles and execution risks. Nonetheless, MediaTek’s strong balance sheet, disciplined capital allocation, and track record of reinvention underscore its potential to remain a pivotal player in the evolving semiconductor landscape.

Disclaimer - The article is for informational and educational purposes only and should not be considered investment advice. While every effort is made to ensure the accuracy and reliability of the information presented, there is no guarantee to its completeness or accuracy.

The views expressed are solely those of the author and may be subject to change without notice. Discussion is based on publicly available information and reflect the author's independent analysis and judgment at the time of writing.

Great read, thanks for sharing.

Great read, thanks for sharing.