Introduction

Lei Jun, the founder CEO of Xiaomi, revealed on 16th May that Xiaomi is going to release its in-house SoC XRING O1. While some may be surprised by Xiaomi’s in-house silicon effort, this is in fact not their 1st SoC as Lei Jun alluded to in its Weibo post. Let’s take a look at the 10 years journey and explore the implication for merchant SoC giants such as Qualcomm & MediaTek.

Source: Weibo

Lei Jun on Xiaomi’s Chip Dream

很多朋友都很关心:做大芯片这么难,小米为什么还要做呢? 这个问题,在 11 年前,我们就反复问过自己,我在 2017 年发布会上也正式回答过。其实这次芯片重启,我们讨论了半年,原因非常简单:小米一直有颗“芯片梦”,如果想成为一家伟大的硬核科技公司,芯片是小米必须攀登的高峰,也是绕不过去的一场硬仗,在芯片这个战场上,我们别无选择!

Translated version

Many people are curious: making advanced chips is so difficult, why does Xiaomi still insist on doing it? This is a question we asked ourselves repeatedly 11 years ago, and I officially addressed it at our 2017 launch event. In fact, we discussed this chip reboot for half a year. The reason is very simple: Xiaomi has always had a "chip dream." If we want to become a truly great hardware tech company, chip is a summit we must climb. This is a tough and unavoidable battle. On this chip battlefield, we have no other choice.

Table of Content

Who is Xiaomi?

Founded in 2010 by Lei Jun, Xiaomi has grown from a disruptive smartphone startup into one of China’s most influential tech giants. Lei Jun is a very famous entrepreneur and angel investor in China who became the CEO of Kingsoft in 1998 at the age of 29. He managed to turnaround the company before leading Kingsoft to IPO in 2007. In 2000, he founded Joyo.com as a side project while he was CEO of Kingsoft. Joyo.com was subsequently sold to Amazon for $75 million in 2004. His early investment in YY and UCWeb also paid off big.

Inspired by Steve Job, Lei Jun saw the potential of mobile internet as the next big wave and wanted to create a high quality made-in-China smartphone. Channel innovation was a key differentiation as it only sold its phones through ecommerce in the early days. By bypassing distributors and physical stores, Lei Jun was able to pass on cost savings to the end consumers. This strategy has led to Xiaomi’s reputation for quality at value pricing product and built a very loyal fanbase known as “Mi Fen”.

Source: Xiaomi

Xiaomi quickly became a global smartphone leader that has consistently ranked among the top five vendors globally. With a global smartphone shipment of 168.5 million in 2024, it is the 3rd largest smartphone OEM globally despite not having presence in the U.S. In 2021, Xiaomi took market share when Huawei was put on Entity List the year before. The loss of access to TSMC’s leading edge node and Android ecosystem put Huawei at a severe disadvantage. Since then, Xiaomi has continued to gain market share from peers such as Vivo and OPPO who were heavily reliant on physical stores distribution in the 2010s.

Source: Counterpoint

Beyond smartphones, Xiaomi has built an expansive AIoT (Artificial Intelligence of Things) ecosystem with over 900 million connected devices, including smart TVs, wearables, and home appliances. In 2024, the AIoT division generated a revenue of RMB104.1 billion, an increase of 30.0% YoY. The launch of an innovative top-flow air conditioner in 2024 led to sales growing more than 55%. This year, they have also launched a central air conditioner product that will take on Japanese giant Daikin.

Source: The Mail & Guardian

Source: Core77

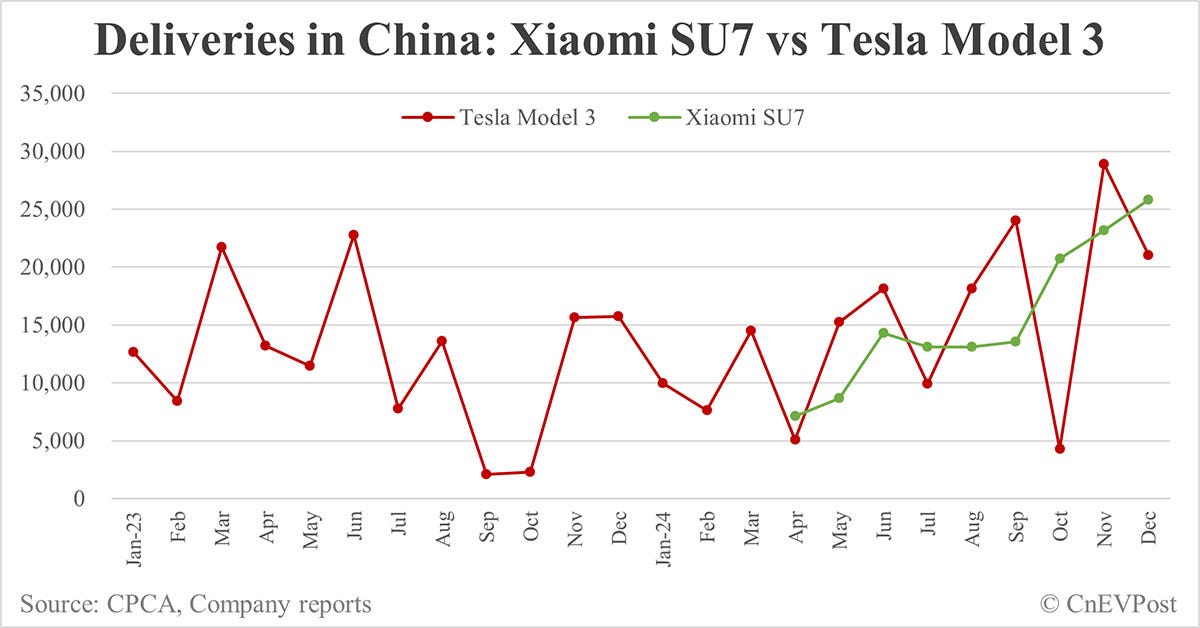

In 2021, Xiaomi announced its intent to enter the EV (electric vehicle) market, which the market thought will be a drag on profits for many years. Xiaomi made headlines with the launch of its first EV sedan, the SU7, in March 2024. Within a year, Xiaomi SU7 deliveries is now higher than Tesla Model 3. The company will be launching a few more models over the years. As current capacity is unable to fulfil domestic demand, they will explore overseas market later on.

Source: Xiaomi

Source: CnEVPost

Xiaomi’s foray into EV completed its long-term vision of creating a "Human x Car x Home" smart ecosystem. With Xiaomi HyperOS as the foundation to connect smartphones, IoT and cars, it creates a seamless and intelligent experience for the users.

Source: Google Finance

Vertical integration kicks out the middleman, which allows Xiaomi to offer cheaper and better-quality product. In the IoT division, it has started to do in-house design of key categories and will be launching its smart home appliance factory at the end of 2025. Unlike BYD, vertical integration is not as extensive in Xiaomi despite its effort. This is due to China’s vast hardware supply chain and the low value-add to replace the suppliers. However, semiconductor design has the ability to create real product differentiation. In the smartphone division, the launch of SoC Xring is a culmination of more than 10 years of work.

History of Xiaomi’s In-House Silicon Efforts

Pinecone Electronics (2014 – 2017)

Xiaomi’s first serious foray into semiconductors started in 2014 with the establishment of Pinecone Electronics (松果电子), a subsidiary focused on designing application processors (APs). Initially, it licensed SDR1860 platform technology from another Chinese fabless company called Leadcore Technology. As Leadcore is part of Datang Telecom, it has numerous modem patents.

In February 2017, Xiaomi released its first in-house SoC, the Surge S1 (澎湃S1). This was fabricated on TSMC’s 28nm node and featured in the Mi 5C smartphone. Surge S1 was a 64-bit octa-core ARM-based SoC featuring 8 ARM Cortex-A53 cores.

While it lagged behind merchant silicon such as the Snapdragon 820 (Samsung 14nm) in performance, the launch made Xiaomi only the fourth smartphone brand globally to develop its own chips after Samsung, Apple, and Huawei.

Limitations in process technology and modem integration held the S1 back from mainstream adoption. Plan for Surge S2 was also shelved due to technical bottlenecks and cost pressures. S2 had multiple tape-out failures and the start of the 5G era further increased the technological barrier. In 2017, revenue scale was smaller as Xiaomi’s smartphone shipment was 96 million at 6% global smartphone market share.

Specialized Chips (2017 - 2024)

After setbacks in its SoC development, Xiaomi pivoted to specialized chips in narrower domains to steadily build its capabilities. This is more capital efficient while it continues to build its chip division capabilities.

In 2019, part of the Pinecone team was spun out to form Nanjing Big Fish Semiconductor (南京大鱼半导体有限公司) to focus on AI and IoT semiconductor. The rest of the Pinecone team continued to focus on smartphone chips.

Over the next few years, multiple specialized chips were released such as C1, P1, G1, and T1.

Imaging

In 2021, Xiaomi launched the Surge C1, its first image signal processor (ISP), on a 28nm process. Surge C1 helped Xiaomi to achieve auto focus, auto exposure and accurate white-balance control in its algorithm. The dual-filter architecture improved image processing efficiency by processing both low-frequency and high-frequency signal at the same time. This was debuted in the foldable Mi MiX FOLD.Fast Charging and Battery Management

In 2021, Surge P1 was launched, and it enabled 120W single-cell fast charging with 97.5% power conversion efficiency. It is able to fully charge a 4600 mAh battery in 18 minutes. This was used in the Xiaomi 12 Pro.

In 2022, Surge G1 was launched as a battery management chip that, together with the P1, formed the “Surge Battery Management System”. This improved overall battery health and safety. Xiaomi 12S Ultra was the first device to incorporate both G1 and P1.

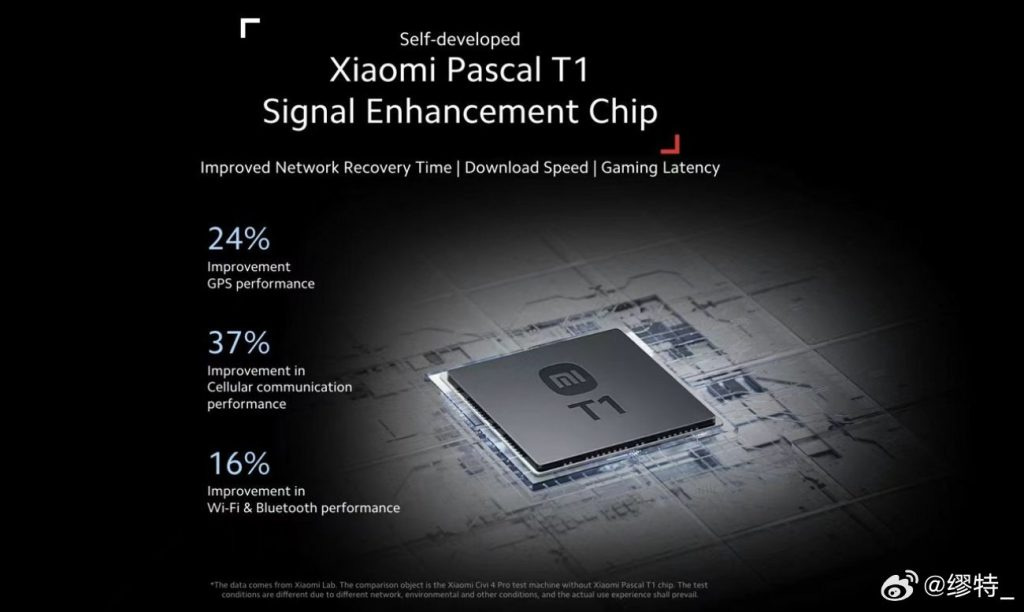

Connectivity & Signal Enhancement

In 2024, Xiaomi released the Surge T1 series to boost the reliability and quality of communication signal. This enables “dead-zone-free” coverage in devices like the Xiaomi 14 Ultra. An improvement of 24% in GPS performance, 37% in cellular communication performance and 16% in Wi-Fi Bluetooth performance are achieved.

Source: Hello Express

Return to SoC: XRING O1 (2025)

On 7th December 2021, Shanghai Xuanjie Technologies (上海玄戒技术) was established with a capital of RMB 1.5 billion. In 2023, capital injection was done to raise total capital to RMB 1.92 billion. The company is currently led by former Qualcomm senior director of product marketing Qin Muyun and former UNISOC CEO Ceng Xuezhong. It is Xuanjie that designed the new flagship SoC XRING O1.

Learning from their 2017 experience, Lei Jun knew that only by designing high-end flagship SoC can they control advanced semiconductor knowhow. When Xuanjie was established, an ambitious goal was set to produce flagship SoC at the most leading-edge node with performance and efficiency on par with Tier 1 global leaders.

Since inception, Xuanjie had spent a total of RMB 13.5 billion (USD 1.9 billion) in R&D expenses. Currently, the R&D team has more than 2500 people with an estimated R&D spend of more than RMB 6 billion in 2025. To give context, RMB 6 billion in R&D spending is more than what other listed Chinese semiconductor companies spent on R&D in 2024. There is no doubt that this is one of the biggest semiconductor design teams in China, one that has been hidden in plain sight.

Source: Listed companies annual report 2024

XRING’s Performance

XRING O1 (玄戒O1) is Xiaomi’s new flagship SoC that will debut in the Xiaomi 15S Pro smartphone, Pad 7 Ultra tablet and Watch 4s. The chip is built on TSMC’s N3E node with 19 billion transistors on an area of 109 mm2. Comparing against Apple A18 Pro, XRING O1 has 5% lesser transistors count with 4% bigger die size. Considering this is Xuanjie’s 1st SoC, the specification is quite impressive.

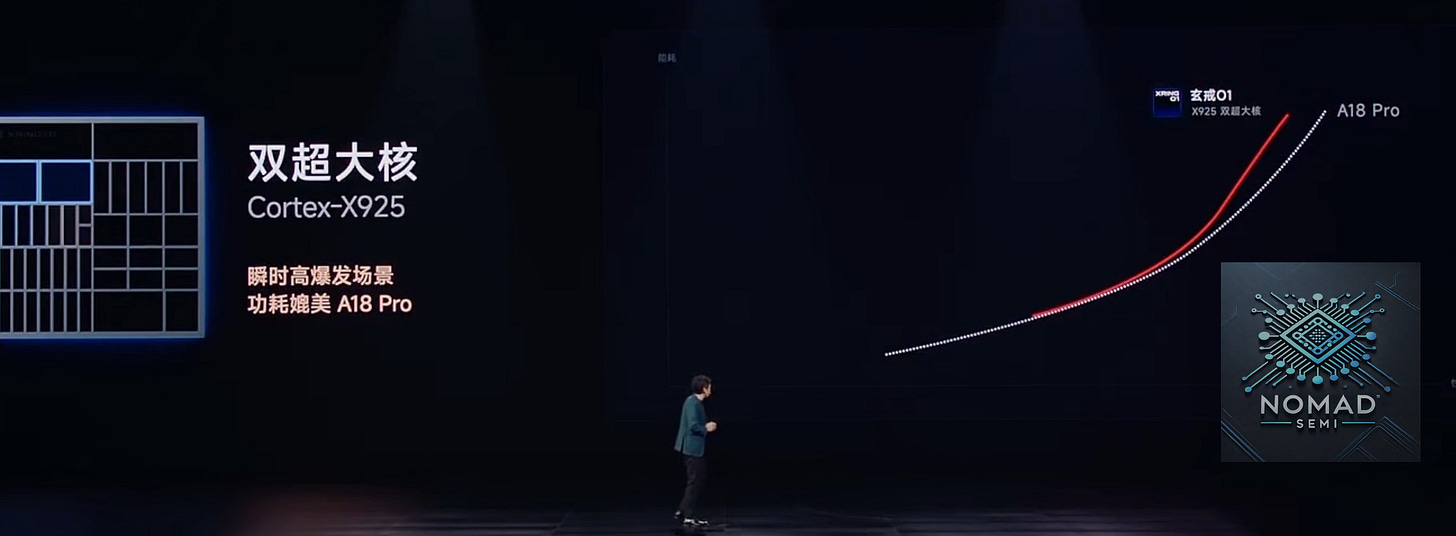

Based on ARM V8 architecture, the XRING processor features a 10-core architecture, headlined by 2 ARM’s high-performance Cortex-X925 core clocked at 3.9GHz. Supporting it are 4 Cortex-A725 performance cores at 3.4GHz, 2 power-efficient Cortex-A725 cores at 1.9GHz and 2 power-efficient Cortex-A520 cores at 1.8 GHz. For daily use, only the 4 power-efficient cores will be utilized. The other 4 Cortex-A725 performance cores will be activated for gaming use, while the 2 big Cortex-X925 cores will be used for maximum performance.

In terms of benchmarking, XRING O1 achieved an ANTUTU score of 3,004,137 which is better than both Qualcomm’s Snapdragon 8 Elite and MediaTek’s Dimensity 9400. Both are the best merchant SoC chips you can find for smartphone in the market.

Source: Antutu

Source: Geekbench

There are a few reasons why XRING O1 is outperforming MediaTek and Qualcomm. The new chipset opts for an ambitious 10-core layout, a departure from the usual octa-core (8 cores) used by MediaTek and Qualcomm. It also includes two of ARM’s latest Cortex-X925 cores that clocked at a lofty 3.9 GHz for peak performance, whereas Dimensity 9400 only used 1 Cortex-X925 core.

In terms of power efficiency, XRING O1 loses out to A18 Pro slightly on the most intensive task.

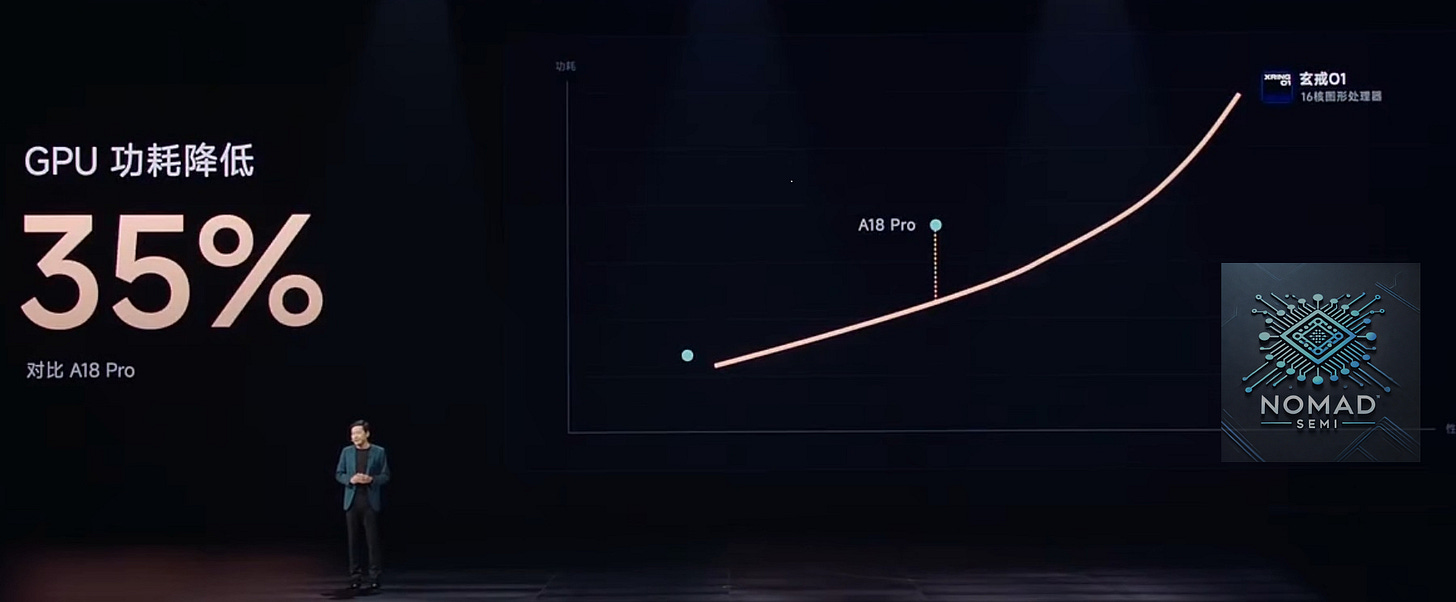

In addition, it is paired with ARM’s Immortalis-G925 GPU with 16 cores that is 4 more than the 12-core Immortalis-G925 configuration in MediaTek’s Dimensity 9400. In the Aztec1440p and Manhattan 3.1 benchmark, XRING O1 outperformed A18 Pro by 43-57%. Power efficiency of the GPU is 35% better than that in A18 Pro. Compared to iPhone 16 Pro Max, the time taken to open an app is 30% faster for Xiaomi 15S Pro.

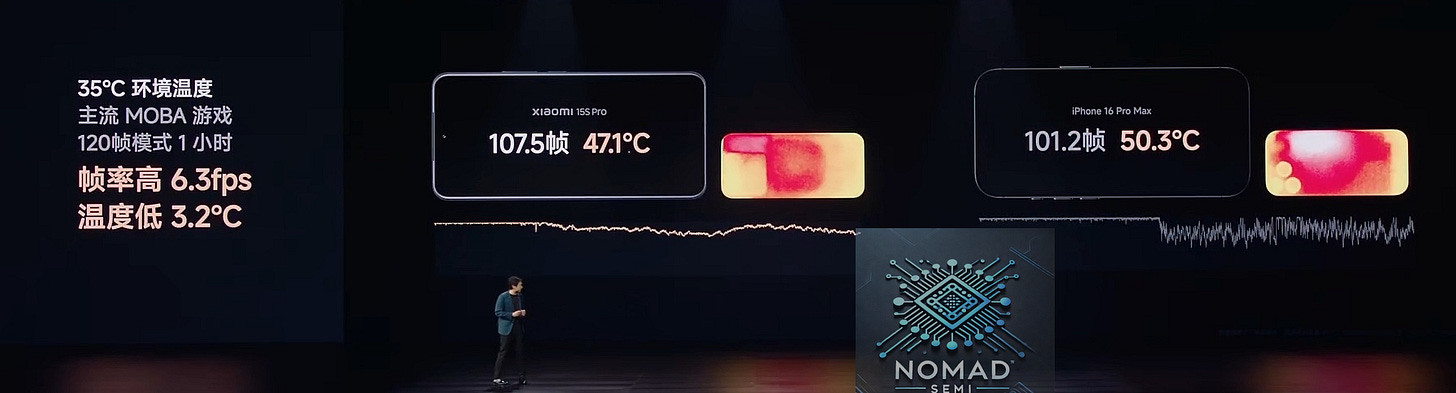

When playing mainstream MOBA game, Xiaomi 15S Pro is able to maintain a lower temperature than than iPhone 16 Pro Max. The difference is even more obvious during summer when the outdoor temperate is 35oC.

Xiaomi also announced the 4th generation in-house ISP V4.

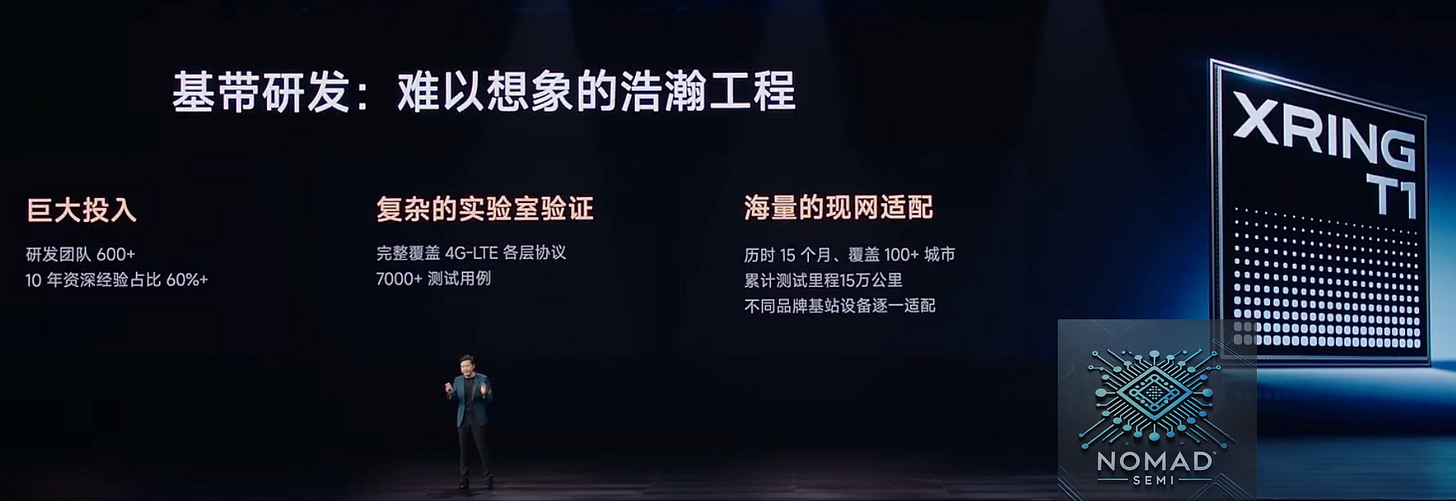

What is most surprising in the presentation is Xiaomi’s XRING T1 modem, which is their 1st 4G modem. Only a few companies globally (Qualcomm, MediaTek, Apple, Huawei, and Samsung) have successfully developed modem. Modem technology cannot be licensed from ARM and companies will have to buy from Qualcomm, MediaTek if they do not have in-house design capability. As much as Apple does not like Qualcomm, it took them many years before they successfully released C1 modem for iPhone 16e this year.

The 4G modem was hard work for Xiaomi which involved a team of more than 600 R&D engineers (60% of which have more than 10 years of experience). The modem was tested for 15 months across more than 100 cities and 150,000 km.

How difficult is it to produce smartphone SoC?

As written in the previous deep dive on MediaTek, SoC is a critical component for smartphone.

SoC is the brain of a smartphone as it integrates multiple components such as CPU for running the OS and processing, the GPU for rendering images and videos, memory controllers, modems for cellular connectivity, and other functions such as the ISP. By combining these elements into one compact chip, SoCs enable smartphones to be powerful and energy-efficient, handling everything from running apps to connecting to networks and processing multimedia content.

Building an in-house smartphone SoC is extremely difficult and resource intensive. It requires a combination of technical expertise, significant investment, licensing of critical IP from ARM and access to manufacturing infrastructure. It takes a few years from the initial design to logic design, physical design, verification and finally tape-out.

While licensing the IP cores from ARM can reduce the cost and time to market significantly, it is still not an easy task. The integration of AP, GPU, modem and multiple functions into a single SoC is done while ensuring it is optimized for performance, thermal and power efficiency. Xiaomi’s Xuanjie is rumored to have at least 1000 employees.

Source: notebookcheck, Dimensity 9400

Another major hurdle is the 5G modem. In the case of Xiaomi 15S Pro, they purchased the 5G T800 modem from MediaTek. Built on TSMC’s 4nm, T800 is designed for sub-6GHz and mmWave 5G networks. It can achieve download speeds of up to 7.9 Gbps and upload speeds of up to 4.2 Gbps.

To be competitive, the product has to be produced on leading edge 3nm and 5nm node at foundries such as TSMC. With increasing scrutiny from U.S. on China semiconductor efforts, this is becoming difficult as Chinese companies fall within the scope of Entity List. TSMC is also not allowed to manufacture 7nm and below AI chip for Chinese companies. Other than TSMC, access to EDA tools is also critical in the design of chips. In 2021, Xiaomi was considered by U.S. Department of Defense as a “CCMC” (Communist Chinese Military Companies) before it was subsequently removed.

Other firms that have attempted SoC development such as OPPO’s Zeku or LG’s Odin had exited due to cost and execution challenges. Zeku was established in 2019 before it was abruptly shut down in 2023. OPPO have been losing market share in the last few years and had shut Zeku due to the heavy ongoing investment requirement. This was a huge team of 3000 employees, and it was said that some was poached by Xiaomi after it was shut. Huawei had great success with HiSilicon before it was put on the entity list in 2020. Back then, HiSilicon’s 5G SoC was not losing out to top tier chips from Qualcomm.

Source: Counterpoint

This is why Xiaomi has adopted a more practical phased approach to its strategic priority of in-house silicon. It focused on ISP, PMIC and signal enhancer before it enters the SoC space again with external modem support. It reflects a recognition that success in in-house silicon requires not just ambition, but patience and long-term investment.

Another reason why Xiaomi is able to deliver XRING is that their revenue of US$ 56 billion is more than 3x bigger when Surge S1 was released in 2017. SoC development is an ongoing fixed cost that only large players such as Apple and Samsung can afford. The higher the market share, the cheaper the per chip cost is as it can be amortized over a larger volume. According to Lei Jun, each generation of chip costs US$ 1 billion in total cost. If used on 1 million smartphones, the cost per chip is as high as $1000 per phone. Strategic concern is obviously a more important consideration than profitability.

In-house SoC can provide significant competitive advantage through a tight integration of both software and hardware. Apple’s in-house SoC has been one of the most successful given its ability to control the iOS ecosystem. Apple is able to optimize iOS, macOS and app performance in ways that other OEMs cannot. This vertical integration also allows Apple to differentiate its products, accelerate innovation cycles and reduce reliance on external vendors like Qualcomm.

While Xiaomi does not have control over Android, it can still achieve a certain degree of software hardware optimization and better user experience. This is an important key pillar of Xiaomi’s strategy to go after the high-end smartphone market. In addition, it will also have better bargaining power over merchant silicon providers such as Qualcomm and MediaTek.

How did Xiaomi overcome the BIS rule?

There is a term in Chinese called 树大招风 (a tall tree attracts winds). Becoming higher profile runs the risk of an entry into U.S. entity list. Some also questions why Xiaomi is allowed to produce a sub-7nm chip if the BIS had banned 7nm chip.

Under the new rule by BIS in January 2025 on Implementation of Additional Due Diligence Measures for Advanced Computing Integrated Circuits, foundries and OSATs have to presume that any logic IC produced at 16/14nm node is designated ECCN 3A090.a and has to be subjected to a global licensed requirement.

To that end, this IFR imposes a broader license requirement for “front-end fabricators” and “OSAT” companies seeking to export, reexport, or transfer (in-country) certain “applicable advanced logic integrated circuits” under ECCN 3A090.a to or within any destination worldwide

In the absence of an attestation of the `total processing performance' and the `performance density' by an approved IC designer listed in supplement no. 6 to part 740 of the EAR, any logic IC produced using the “16/14 nanometer node” or below, or using a non-planar transistor architecture and destined for an item with an “aggregated approximated transistor count” exceeding the applicable number of transistors (as specified for the year of the export, reexport, or in-country transfer) within the package, or where the “aggregated approximated transistor count” of the final, packaged item cannot be confirmed by the “front-end fabricator” or “OSAT” company as described above, is presumed to be a 3A090.a item designed or marketed for a datacenter.

Source: BIS

The first way around it is to be an authorized IC designer, which is unlikely for Xiaomi.

Source: Wilson Sonsini

What Xiaomi did was through the 2nd mechanism where the IC chip is packaged by a front-end fabricator outside of China. Given the chipset is N3E, this is fabricated by TSMC in Taiwan. Next, the Xring O1 chip has a total of 19 billion transistors, which is below the 35 billion transistors threshold.

The second mechanism for overcoming the presumption relates to the location in which the IC die is packaged by the front-end fabricator. If that activity occurs outside Macau or a Country Group D:5 destination, then the presumption can be overcome if the front-end fabricator is able to attest to both of the following two facts:

either "the 'aggregated approximated transistor count' of the final packaged IC is below 30 billion transistors" or "the final packaged IC does not contain high bandwidth memory (HBM);" and

the "'aggregated approximated transistor count' of the final packaged IC" falls under certain thresholds.

The aggregated approximated transistor count thresholds are dependent on the year in which the export, reexport, or in-country transfer is completed. The threshold for 2027 is 35 billion transistors. For 2029 and later, the threshold is 40 billion transistors.

Source: Wilson Sonsini

Implication for Qualcomm and MediaTek

The impact of Xiaomi’s Xring is definitely negative to both Qualcomm and MediaTek, especially in the Chinese market. Both companies have benefitted a lot since the downfall of Huawei in 2020. Samsung’s foundry failure has also allowed Qualcomm to gain higher share within the high-end SoC market for Samsung. Now, the trend is slowly reversing with the comeback of Huawei and the release of XRING.

The trend in the last 5 years has been a shift towards merchant silicon as Huawei was put on entity list (banned from accessing TSMC’s technology in 2020) and Samsung was unable to deliver on its foundry process technology. For Galaxy S25, Samsung decided to use Qualcomm Snapdragon Elite 8 exclusively for the second time in recent years. While Oppo had tried to design their in-house chipset in 2019, they shut down the Zeku division in 2023.

However, the magnitude of the impact is manageable for now as Xiaomi will be launching XRing for a limited number of SKUs. The likely volume for XRing should be less than 5 million, which is only low single digit of its total smartphone shipment. The annual merchant silicon market between Qualcomm and MediaTek is more than 600 million units a year. Certainly, it is just a small dent.

Source: Counterpoint

Between Qualcomm and MediaTek, it is likely that Qualcomm will be impacted more. Xiaomi is known to be the biggest user of Qualcomm’s SoC in China, especially in the premium smartphone segment. Qualcomm's Snapdragon processors are predominantly featured in Xiaomi's flagship devices such as the Xiaomi 15 Ultra and Xiaomi 15.

Conversely, MediaTek's Dimensity series power many of Xiaomi's low to mid end models such as Redmi and POCO. For MediaTek, they will benefit as XRING likely uses external modem from MediaTek. The ASP of each modem should be north of $30.

As XRING can serve as a bargaining chip during price negotiations, this could lead to pricing pressure for both Dimensity and Snapdragon chips in the longer term. A shrinking merchant silicon market could also reignite a price war for market share between Qualcomm and MediaTek. While XRING is impressive, it is still far away from where HiSilicon was at the peak in 2020. The launch of 4G modem XRING T1 is not a good sign, although we won’t know when their in-house 5G modem is ready.

Xiaomi’s Semiconductor Investment Portfolio

Remember Lei Jun’s reputation as a Venture Capital (VC) investor in China? He had set up a very successful VC firm called Shunwei Capital in 2011.

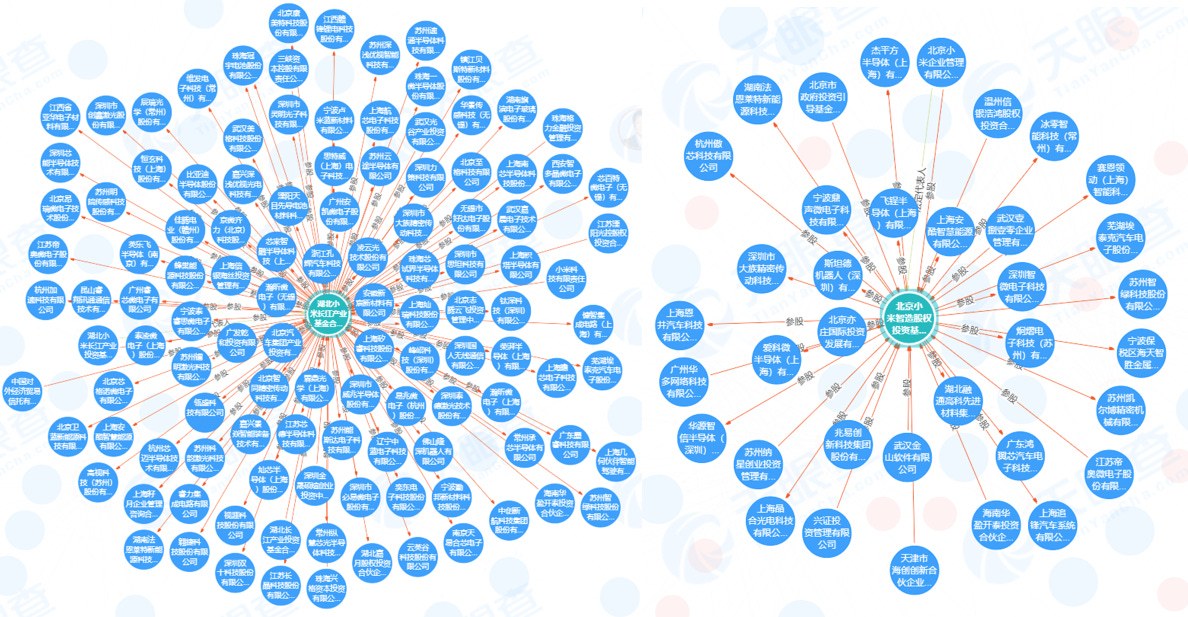

Xiaomi has been actively involved in VC investing for many years too. It had raised a RMB 10 billion (US$ 1.4 billion) fund called Beijing Xiaomi Zhizao Equity Investment Fund (北京小米智造股权投资基金) in 2022 to invest in semiconductor related companies or in other areas such as smart manufacturing and new materials. The other main investment vehicle is Hubei Xiaomi Yangtze River Industry Investment Fund (湖北小米长江产业投资基金) which was established in 2017.

Source: Manjusaka

Through the two investment vehicles, Xiaomi had invested in more than 100 semiconductor companies in China. Some are well-known semiconductor companies in China such as Bestechnic, Black Sesame, BYD Semiconductor, Chipone, CXMT, GTA Semiconductor, Robosense, Smartsens and Vanchip. Xiaomi often comes in as the role of a strategic investor rather than a pure financial investor.

Conclusion

Beneath the surface, the company has quietly built one of China’s most ambitious in-house semiconductor design programs. From AP and ISP to connectivity chips and fast charging chips, Xiaomi’s multi-pronged silicon strategy is a critical element of its vertical integration push. It is also a potential catalyst for product differentiation as Xiaomi seeks to penetrate deeper into the high-end market.

A key lesson is that China’s most successful semiconductor efforts often come from successful system companies like BYD, Huawei and Xiaomi. For these firms, chip development is not an end in itself but a strategic step toward full-stack system innovation. It enables deeper hardware software integration and product differentiation. In fact, the most successful semiconductor startup of the past 20 years in the world has been Apple’s in-house silicon team. With control over the end product, these companies can tailor silicon to their specific needs to create a competitive advantage without the need to sell them externally.

For both Qualcomm and MediaTek, the short-term impact is limited for now. Investors should not panic as both companies are pursuing their new growth drivers beyond smartphone. For fabless companies, the biggest threat has always been the system companies (Apple, Google, Amazon, Meta, Samsung, BYD, Xiaomi).

Great work. Thanks for all that work.