Earnings Decoder: Advantest, Intel and SK Hynix

Signs of pull forward demand

Advantest

For those unfamiliar, Advantest is the sole provider of final testers for NVIDIA’s Blackwell chips. The high-end tester market is dominated by Advantest and Teradyne, with Advantest gaining share in recent years thanks to its strength in AI-related testing.

In a potential sign of softening CoWoS demand, Advantest is now guiding for a flattish sales outlook for FY2025. While a stronger yen has a mid-single digit impact on revenue, the market was still expecting a much stronger growth trajectory for the year.

As far as the first half versus the second half guidance, usually, we don't have as much visibility into the second half just because most of the visibility we have is 6 months out. But we do see a stronger first half right now as we stand at this point in the year.

So as Doug just explained, there might be in comparison, first and half, the first half is going to be a little bit higher, and it will be a huge gap. And with regards to the gap, as Doug just explained, for the second half, there is - we don't have full visibility. There might be some uncertainties.

Source: Advantest

Advantest should see stronger demand in 2026 as Rubin will lead to longer testing time again. Tester company benefits when the product upgrade cadence is faster.

Pull forward demand

There is growing evidence of demand pull forward in specific segments like PCs and iPhones. While the additional pull forward demand is perhaps only about 10% in a quarter, it is significant for ex-growth categories such as smartphones and PCs.

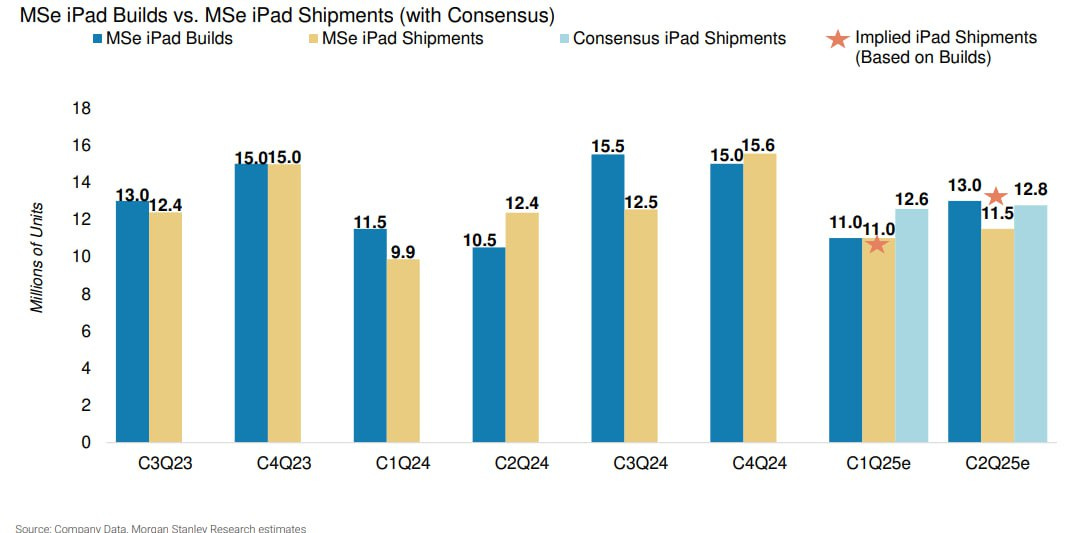

Both Q1 and Q2 tend to be low seasons for iPhone suppliers as the 2nd half of the year is when builds begin for the new iPhone launch in September. According to numbers from Morgan Stanley, Apple’s Taiwanese supply chain partners reported sales growth of 33.5% in March which is much higher than historical growth. In Q2, Morgan Stanley also estimated iPad builds of 13 million +23.8% YoY and iPhone builds of 45 million +15% YoY.

Source: Morgan Stanley

For PCs, Counterpoint reported 6.7% YoY growth in Q1 2025 “driven by pull-ins in anticipation of US tariffs and growing adoption of AI-enabled PCs.”

HP and Dell, on the other hand, benefited from the US market pull-ins during the quarter, with 6% and 4% YoY growth respectively, and maintained their second and third places in Q1. We also found that the pull-ins happened for other major brands too ahead of the tariff uncertainty, leading to the market share further consolidating around major brands.

In an earlier article, I have mentioned the higher notebook shipment by the ODMs in Q1.

Notebook shipment by the ODMs in Q1 grew 3% YoY, which is 10% higher than seasonality. In particular, notebook shipment in March grew by 39% MoM. In fact, ODMs have already started to prebuild inventory since November after President Trump won the election. Both AMD and Intel have seen double digit growth for PC CPU shipment in Q4, which is much higher than flattish PC unit shipment.

Source: Counterpoint

The latest Federal Reserve Biege Book in April is seeing stronger sales of vehicles and other nondurables

Non-auto consumer spending was lower overall; however, most Districts saw moderate to robust sales of vehicles and of some nondurables, generally attributed to a rush to purchase ahead of tariff-related price increases. Both leisure and business travel were down, on balance, and several Districts noted a decline in international visit

Intel

While Intel’s Q1 results was a beat, the forecast for Q2 was weaker than expected as they expect a 2 to 12% sequential decline in revenue. Intel noted similar dynamics of early pull-in of notebook shipment by the ODMs since November 2024

Similar to Q4 2024, we believe Q1 revenue benefited from customer purchasing behavior in anticipation of potential tariffs, though it is difficult to quantify the magnitude.

Investors were also stumped at why Intel is capacity constrained at N7 instead of Meteor Lake and Lunar Lake. First sold in October 2022, it is rare to see demand for an older CPU exceeding that of the newer chip.

Greater demand from our customers for N-1 and N-2 products so that they can continue to deliver system price points that consumers are really demanding. As we've all talked about, the macroeconomic concerns and tariffs, have everybody kind of hedging their bets and what they need to have from an inventory perspective. And Raptor Lake is a great part

There are 2 reasons why Raptor Lake is of a cheaper cost structure than Lunar Lake, Arrow Lake and Meteor Lake.

Intel took a $3 billion write-off of Intel 7 in Q3 2024 under ex-CEO Pat Gelsinger

Both Arrow Lake and Lunar Lake are manufactured by TSMC, which has lower gross margin than internal products. Some of the chiplets in Meteor Lake are made by TSMC too

This also suggests that the king of CPU is fighting a fierce price war with AMD.

Comments from Intel also suggest that outsourcing to TSMC will continue in the foreseeable future. Now, we shall see if Intel will outsource server CPU to TSMC.

Michelle C. Johnston Holthaus

And so when you look at Nova Lake, really what we have done is we've optimized at the SKU level, the process node that we're going to use. And so when you look at Nova Lake, you'll see product both at TSMC and you'll see product internal to Intel. But when you look at the aggregate of Nova Lake, we will build more wafers on Intel process than we are on Panther Lake.

David A. Zinsner

I'd just add one other thing that just I come over the top of the organization on is we are going to continue to balance internal and external manufacturing of wafers. We do that because that's part of our capital strategy to maintain a reasonable capital intensity relative to the business.

New CEO Tan Lip-Bu’s restructuring effort is a step in the right direction by taking decisive steps to streamline the company’s operations and sharpen its focus. He is flattening the leadership structure so that all critical functions (including product, manufacturing, and G&A) report directly to him.

This change is designed to reduce layers of management and enable the CEO to work more closely with Intel’s product and engineering teams, ensuring faster decision-making and tighter execution. As part of this broader effort, Intel is also targeting significant cost reductions, with operating expenses expected to fall to $17 billion in 2025 and further to $16 billion in 2026. Fixing the cultural rot at Intel is important

Tan Lip-Bu

One of my biggest learning so far is that we need to fundamentally transform our culture and the way in which we operate. Organizational complexity and bureaucracies have been suffocating the innovation and agility we need to win. It takes too long for decisions to get made. New ideas and people who generate them have not been given the room or resources to incubate and grow. The unnecessary silos have led to bad execution.

In a message to Intel’s employees, Tan Lip-Bu said

I’ve been surprised to learn that, in recent years, the most important KPI for many managers at Intel has been the size of their teams. Going forward, this will not be the case. I’m a big believer in the philosophy that the best leaders get the most done with the fewest people. We will embrace this mindset across the company, which will include empowering our top talent to make decisions and take greater ownership of key priorities.

SK Hynix

The company delivered strong earnings growth, with gross margin expanding to 57% and operating profit increasing 158% YoY. While weaker memory prices had some impact, HBM now accounts for 40% of total revenue and an even larger share of operating profit.

Source: SK Hynix

Despite some suggestion that Samsung is expected to be qualified by Nvidia for 12-Hi HBM3e, this is still highly uncertain and not impactful even if it happens. Based on the production cycle and inventory build, it is too late for Samsung if they get qualified. SK Hynix is achieving 12-Hi HBM3e bit sales crossover in Q2, so Nvidia is already preparing inventory for GB300 shipment in 2026. Samsung is also not achieving good progress in 1c nm node, which they plan to use for HBM4.

SK Hynix now expects HBM demand to grow at 50% CAGR from 2024 to 2028. This does suggest some slowdown in HBM growth rate going forward.

HBM Growth Rate based on SK Hynix’s guidance

2024: 300% for SK Hynix

2025: 100% for SK Hynix

2026-28: 35% CAGR for industry

This should not be a surprise if you have paid attention to Nvidia at GTC 2025. Rubin is featuring 288GB HBM4 capacity which is similar to that of Blackwell Ultra. This will impact HBM equipment suppliers such as Disco and Camtek as sales growth normalized. For SK Hynix, they will still benefit from double digit ASP uplift with migration from HBM3e to HBM4.

Source: Nvidia

There are more mentions of pull-in demands and rush orders in the company’s commentary

To share our current ongoing discussions with customers regarding supplies, global customers are generally maintaining their planned memory demand, as previously discussed with us. In fact, some customers are even requesting short-term supply pull-ins to expedite their demand.

For IT consumer goods such as PC and smartphones, tariffs are on temporary hold for now. Additionally, from the perspective of end customers, there is a possibility that some of them may rush purchases before price increase, which could, in turn, stimulate replacement demand.

So in Q1, tariff policies were not finalized. As a result, while some pull-in demand from customers may be reflected in the results, it did not come in a significant way and the impact was relatively limited. So our Q1 DRAM shipment exceeded original projection, but not by a significant margin, and the increase was mostly limited to client products such as mobile and PC. In addition, we understand that customer inventory levels did not show significant changes either.

In Q1, demand in the NAND market for major applications remained weak due to seasonal factors. However, there were signs of preemptive purchasing, particularly for some channels and discrete products, mainly driven by tariff considerations and potential inventory reductions. Coupled with suppliers' production cutbacks, this resulted in a price increase, especially in the spot market. In Q2, following the announcement of tariff policies, uncertainties have increased around the recovery of demand, both for discrete products, where demand had increased in Q1, as well as for major applications.